Looking for the best personal loan apps? Today, getting a loan has gotten much simpler. We don’t have to wait in long lines at the bank anymore to show documents and wait for approval or rejection. Now, there are apps that help us get a personal loan without leaving home. Digitalisation has made things easy on the personal loan front.

This article lists the best personal loan apps to help you quickly get that personal loan.

Best Personal Loan Apps And What They Offer!

| Personal Loan Provider | Rate of Interest (per month) | Highest Loan Amount (Rs.) | Lowest Loan Amount (Rs.) | Additional Features |

|---|---|---|---|---|

| Buddy Loan | 11.99% | 15,00,000 | 10,000 | Documents picked up from residence for verification; Additional loans without further proof |

| PaySense | 1.08% to 2.33% | 5,00,000 | 5,000 | No salary slips required; Partnered with leading NBFCs |

| Freo Money | 1.08% to 2.3% | 5,00,000 | 3,000 | Paperless application; Relaxed EMI repayment tenure |

| Nira | 1.5% to 2.5% | 5,00,000 | 3,000 | Auto-debit option; Instant approval |

| CASHe | Starts from 1.75% | 5,00,000 | 5,000 | Buy Now Pay Later option; Blockchain-based transactions |

| Simpl Pay Later | 36% to 38.5% penalty for late payment; 0% if payment made on time | 25,000 | 1,000 | Buy Now Pay Later; No interest if payment made before due date |

| Lazy Pay | 12% to 36% p.a. | 5,00,000 | 3,000 | Instant loans; Paperless and digital process |

Let’s get into the deets of each of these personal loan apps to get ta better idea about them and choose the safest option.

1) Buddy Loan

Buddy Loan is a great personal loan app that can give instant loan amounts ranging from Rs.10,0000 to Rs.15,00,000 without much paperwork.

Buddy Loan offers to pick up your documents from your place of residence for verification. After verification, you can quickly receive the loan amount. Another great feature of Buddy Loan is that you can obtain additional loans without needing further proof.

Key features

- Rate of Interest (per month) – 11.99 %

- Highest Loan Amount that can be given – Rs.15,00,000

- Lowest Loan Amount that can be given – Rs.10,000

- The loan approval rate of 80% means the chances of securing a personal loan are pretty good

- Documentations required –

- Proof of Identity (Aadhar card/PAN card),

- Address proof like Aadhar card, bills, or rental contract

- Income proof like bank account statement.

- Passport Size Photos

The only thing we find the Buddy Loan to be stiff is that the rate of interest they charge is too high for personal loans, which may let them lose a lot of clientage.

2) PaySense

PaySense is a great app that doesn’t ask for your salary slips before handing out loans. PaySense has integration with LazyPay, and this app can swiftly provide you with personal loans ranging from Rs.5,000 to Rs.5,00,000.

The best thing about PaySense is that it collaborated with India’s leading Non-Banking Financial Companies(NBFCs)[ NBFCs come under the RBI regulation under the Reserve Bank of India Act.] like Credit Saison India, Fullerton, IIFL, PayUFinance, and IDFC First Bank so ensures that they are an up-and-coming personal loan service providing entity.

PaySense offers to pick your documents from your home, eradicating the need to parcel or scan digital documents.

Key Features

- Rate of Interest (per month) – 1.08 to 2.33 %

- Highest Loan Amount that can be given – Rs.5,00,000

- Lowest Loan Amount that can be given – Rs.5,000

- It offers personal loans to loanees with zero credit records as well

Documentations required :

- Proof of Identity (Aadhar card/PAN card),

- Address proof like Aadhar card, bills, or rental contract.

- Income proof like bank account statement.

- Passport Size Photos

3)Freo Money

Freo Money, earlier known as MoneyTap is another personal loan app that facilitates quick access to personal loans. Initially, you must download the app and register on the website. Following registration, you need to submit documents online for verification. Based on the documents you submitted and your credit score, you can swiftly obtain an instant loan ranging from Rs.3,000 to Rs.5,00,000.

They offer exclusive offers for selected customers where they can get a loan of up to Rs.10,000 at a 0% interest rate.

Freo Money offers personal loans for a lot of things like-

- Medical Emergencies

- Bill Payments

- Family Functions

- Education

- Travel

- Rental Deposit

Key Features

- Rate of Interest (per month) – starting at 1.08% per month (13% p.a.), up to 36% p.a. depending on credit profile.

- Highest Loan Amount that can be given – Rs.5,00,000

- Lowest Loan Amount that can be given – Rs.3,000

Documentations required:

- Proof of Identity (Aadhar card/PAN card),

- Address proof like Aadhar card, bills, or rental contract.

- Income proof like bank account statement.

- Passport Size Photos

The best thing about Freo Money is that it offers your paperless personal loan and a very relaxed EMI repayment tenure that ranges from 2 to 36 months, depending on your choice. Also, the loan approval can be as fast as 4 minutes from submitting your documents online.

Also Read: How to Witness 3D & Augmented Reality via Google’s 3D Animals

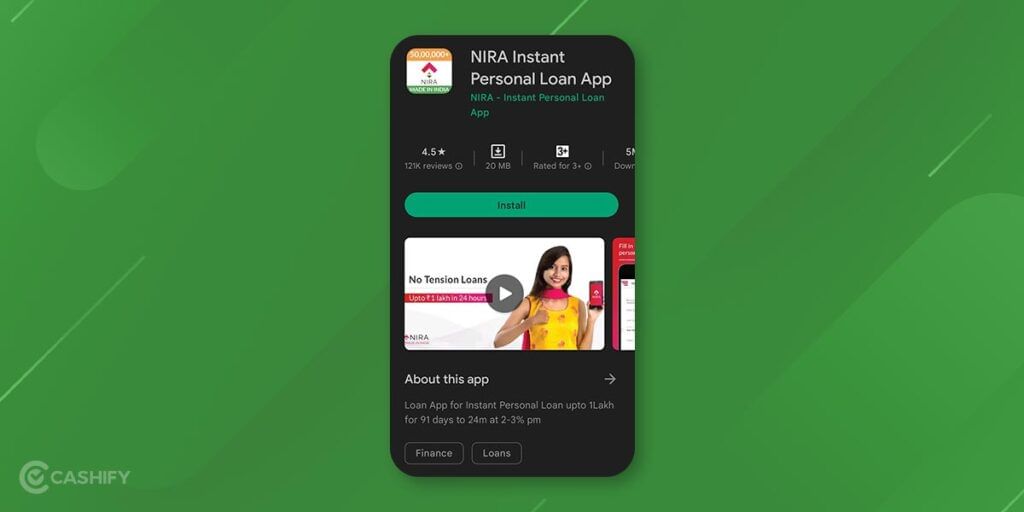

4) Nira

Nira Instant Personal Loan App is a great personal loan app where you get quickly approved loans within minutes.

The option of Auto-debit is an easy and automatic way to set up your monthly EMI payments with Nira.

Once you register on the app and upload your documents online, it will automatically estimate your credit score and give you an instant personal loan without any costs. You can get a personal loan of up toRs.5,00,000, and the interest rate varies from 1.5 to 2.5% per month, riding on your credit score.

Key Features

- Rate of Interest (per month) – 1.5 to 2.5 %

- Highest Loan Amount that can be given – Rs. 5,00,000

- Lowest Loan Amount that can be given – Rs. 3,000

Documentation required:

- Recent payslip

- Last three months’ bank statement

- PAN card, Photograph

- Identity proof like Aadhaar Card, Passport, etc.

- Address proof like utility bills, electricity bills, and rent agreement

5) CASHe

CASHe, akin to other personal loan apps, follows a similar registration process. Here, you submit your documents online and patiently await approval of the personal loan amount, contingent upon your credit scores and the submitted documents. Subsequently, you can procure an instant personal loan of up to Rs.3,00,000 via this app. Additionally, the app presents various EMI options, spanning from 2 months to 1 year, ensuring flexibility in repayment.

The best thing about this app is that there are no pre-closure charges, that is, the costs imposed at the time of closure of a loan, that is, ultimately paying the loan, which contains the principal borrowed and the interest at the time of closure.

CASHe offers the ‘Buy Now Pay Later’ option with leading brands like-

- Myntra

- Uber

- Apollo Pharmacy

- Big Basket

- Amazon

- Flipkart

CASHe App offers you to transfer money to your loved ones as well.

Just choose the people from your phone contact list, and the buddy transfer option guarantees the funds reach their bank accounts. Supported by the blockchain-based infrastructure, it assures that all transactions are secure, protected and translucent.

Key Features

- Rate of Interest (per month) – Begins from 1.75 %

- Highest Loan Amount that can be given – Rs. 5,00,000

- Lowest Loan Amount that can be given – Rs. 5,000

Documentation required:

- Proof of Income like the salary slip

- Identity proof is necessary, like a passport, Aadhar card, driving license, or voter ID.

- Proof of Address through bills like electricity, gas, telephone, maintenance, etc.

- PAN card

CASHe is known for its strict background check before any loan amount is approved, so people need a terrific credit score to avail of money from this app.

6) Simpl Pay Later

Simpl is a ‘Buy Now Pay Later’ type of personal loan-providing app available on more than 15,000 brands. You need to sign on to the app, providing your PAN details and personal information, and you can get an instant personal loan of up to Rs.25,000 based on your credit score history. This app suits people who shop for everyday items, and it generates your Simpl bill twice a month. It combines all your transactions between the 1st and 15th into one bill, which is generated on the 15th. Similarly, transactions made between the 16th and the 30th/31st are combined into another bill generated on the 30th/31st. No interest is charged if you make payments of the generated bill before the due date.

Key Features

- Rate of Interest (per month) – 36 to 38.5 % penalty imposed on the loan amount late payment. Suppose payment is made on time, then 0% rate of interest.

- Highest Loan Amount that can be given – Rs. 25,000

- Lowest Loan Amount that can be given – Rs. 1,000

Documentation required – PAN Card Details.

7) Lazy Pay

LazyPay offers instant personal loans for all your needs, big or small. With this app, you can get online loans within minutes and use it for anything you want – no questions asked. Moreover, their instant personal loans are cash loans where the lump sum amount is transferred to your bank account. The entire process is paperless and 100% digital, for your convenience.

The personal loan interest rates range from 12% to 36% p.a. with EMI tenures from 3 months up to 60 months.

Key Features

- The highest Loan amount that can be given- Rs. 5 lakh

- Lowest loan amount that can be given- Rs. 3000

- Rate of interest- from 12% to 36% p.a. with EMI tenures from 3 months up to 60 months.

Also Read: How to Check Battery Health in Android Phone?

Frequently Asked Questions

Q1. What can a personal loan be used for?

A personal loan can be used for almost any type of expense, from electronic purchases and home renovations to luxury vacations and debt consolidation. You can use personal loans for emergency medical bills, business investment, car repair, or the down payment on a house or car.

Q2. Who all are eligible for a personal loan?

A person with a regular source of income can avail of a personal loan whether you are a salaried individual or a self-employed business person. Additionally, the company where a person works, his or her credit history, his or her residential address and other factors are taken into consideration. These factors determine a person’s eligibility.

Q3. How is the maximum loan amount decided?

Normally, banks and financial institutions calculate the maximum small personal loan amount based on the borrower’s take-home pay avoiding EMI amounts exceeding 30% to 40% of that salary. As part of the calculation of the personal loan amount, any existing loans the applicant has are also taken into account. Self-employed borrowers will have their loan value determined based on their most recent Profit/Loss Statement, while any additional liabilities (such as loans for business, etc.) will be considered.

Q4. What factors do banks consider when determining the maximum amount of a personal loan?

Regardless of the differences in loan sanctioning criteria between banks, credit score, income level, and current liabilities all play key roles in determining the maximum loan amount you may qualify for. When you have a high credit score (like 850+), lenders will feel you are a safe borrower because you have previously paid back your previous loans and/or credit card debts promptly. A person’s repayment capacity is directly influenced by their income levels and their liabilities (outstanding credit card dues, unpaid loans, current EMIs, etc.). Low-income individuals with multiple credit cards or unpaid EMIs would be sanctioned a smaller loan amount compared to individuals with higher incomes.

Q5. In what way are personal loans disbursed?

Your personal loan amount may be deposited automatically into your savings account in the form of a check or draft deposited to the account payee.

Conclusion

Thanks to the proliferation of personal loan apps on the market, quick cash loans are now easier to get. There are countless possibilities when searching for fast cash loans in India and comparing the multiple cash loan applications in India, ranging from payday loans to instant loans. Thanks to personal loan apps, fast and cheap cash loans in India are now a reality. A secured personal loan app download simplifies getting a personal loan.

We hope our article has helped you shortlist the personal loan app best suited to your requirements.

Also Read: How To Book An Appointment For Aadhar card?

Did you know that refurbished mobile phones cost almost 50 per cent less than new phones on Cashify? You also get other discounts, No-cost EMI and more, making it the most affordable way to buy a premium phone. So, what are you waiting for? Buy refurbished mobile phones at your nearest cashify store and avail exclusive offers.