Prime Minister Narendra Modi has launched a new payment method in our country. The electronic voucher-based digital payment system is called “e-RUPI” and is projected to become the stepping stone towards having a digital currency. The platform has been developed by the National Payments Corporation of India (NPCI), the same organisation that created Unified Payments Interface (UPI).

Also read- Upcoming Smartphone Launches

What is e-RUPI?

e-RUPI is a cashless & contactless payment system. It creates an SMS-string code or QR code that will be sent to the user’s mobile phone. Once the code is received, the person can redeem the code from an authorised centre and get their payment. In general, it is sort of a prepaid gift card-based digital voucher that a person can redeem at a dedicated accepting centre.

How will e-RUPI work?

e-RUPI works on simple gift-card based technology. You can present the code to a centre, and they can immediately provide you with the amount. You’ll also not require any debit/credit card, mobile app, or internet banking to use the service.

Also read- How To Download Covid-19 Vaccine Certificate Online

How will e-RUPI vouchers be issued?

Every e-RUPI voucher must be issued by a bank in collaboration with a corporate or government entity. NPIC has already onboarded banks that can issue the e-RUPI vouchers. Apart from that, the sponsoring organisations have to provide details of their beneficiaries and their mobile number and the purpose for which the e-RUPI voucher is being created.

Which Bank can issue e-RUPI?

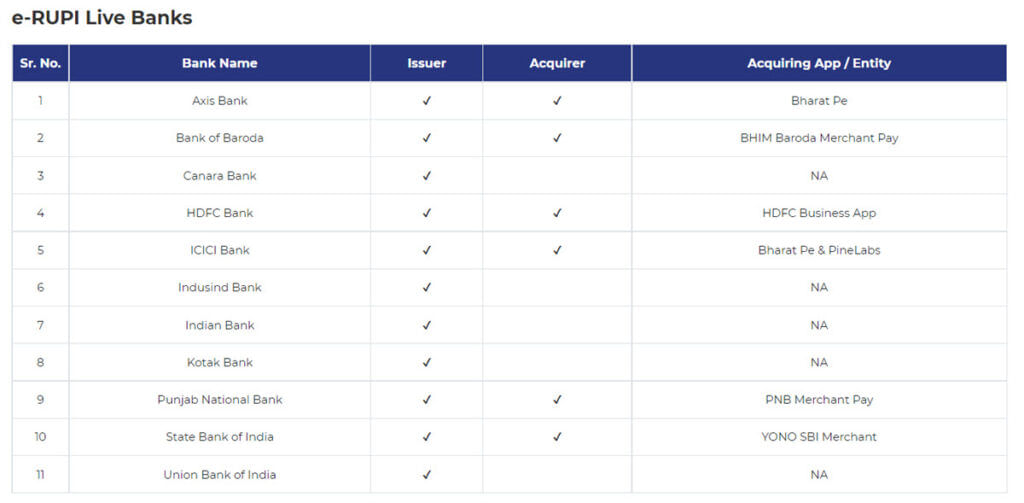

As of now, only 11 Banks can issue an e-RUPI voucher to any sponser of government body.

What will be the benefit of e-RUPI?

As per the Government of India, e-RUPI is a revolutionary digital payment service that will ensure a leak-proof delivery of welfare services. The private sector can also leverage this method and use digital vouchers for employee welfare or corporate social responsibility.

Also read- How To Watch 2021 Tokyo Olympics Online For Free in India

Is it a Digital Currency?

No, e-RUPI is not a digital currency. However, it could potentially be a step in creating a digital currency. According to Indian Express, e-RUPI would be able to highlight any issues in the digital payments system. Hence, the success and failure rate of a possible digital currency could be analysed.

Will I be able to use e-RUPI wherever I want?

NO, e-RUPI can only be used for the purpose it has been created for by the sponsor of the e-RUPI voucher, be it a private organisation or government organisation.

For more information on e-RUPI long on NPIC website.