Flipkart has expanded its digital payment offerings by launching its own Unified Payments Interface (UPI) service. This new service allows users to create a unique UPI handle for making online and offline transactions, both within the Flipkart platform and with other merchants. This comes in when Paytm Payments Bank has discontinued its services as directed by RBI.

What is Flipkart UPI?

Through the Flipkart app, users can leverage Flipkart UPI for various purposes, including online purchases, Scan and Pay transactions using UPI IDs, bill payments, and recharges. Additionally, Flipkart plans to introduce loyalty features specifically for UPI payments soon.

Also read: Activate UPI Using Aadhar Using These Easy Steps!

Initially available only on Android devices, Flipkart UPI is powered by Axis Bank, Flipkart’s existing partner for co-branded credit cards. Leveraging a collaboration with Axis Bank, Flipkart has introduced this new digital payment platform – Flipkart UPI. Seamlessly integrated within the Flipkart app, this service transcends the realm of online shopping payments.

It empowers users to seamlessly transfer funds to local vendors by using scan and pay feature, friends, and family using diverse identifiers like UPI IDs, phone numbers, or QR codes. This innovative solution marks a significant stride in expanding the digital payment experience for the Flipkart user base.

Also Read: What Is UPI Lite? Key Features, Advantages, And Everything You Need To Know

Is Flipkart UPI Safe to Use?

Understanding security is crucial when expanding into the digital payment landscape. Fortunately, Flipkart UPI leverages the existing security framework of the Unified Payments Interface (UPI). Here’s a breakdown of the safety features you can expect:

1. Two-factor Authentication (2FA): Similar to other UPI applications, Flipkart UPI employs 2FA for enhanced security. This necessitates both your unique UPI PIN and a one-time password (OTP) sent to your phone for transaction authorization.

2. Secure PIN: Users will establish their own unique UPI PIN to authorize transactions, adding a layer of security.

3. Encrypted Communication: Data transmission between your device, Flipkart’s servers, and the bank’s system is encrypted using industry-standard protocols. This encryption makes it exceptionally difficult for unauthorized individuals to intercept sensitive information.

Despite all of this, we urge you to make note of a few things and some safety precautions are must. These include:

- Maintaining UPI PIN Confidentiality.

- Treat your UPI PIN like your ATM PIN – never share it with anyone.

- Avoid clicking suspicious links or entering your UPI PIN on unfamiliar websites or apps, as they could be phishing attempts designed to steal your information.

- Finally, If you notice unauthorized transactions or any suspicious activity on your account, immediately report it to your bank to minimize potential damage.

Also Read: Activate UPI Using Aadhar Using These Easy Steps!

How to Setup and Use Flipkart UPI?

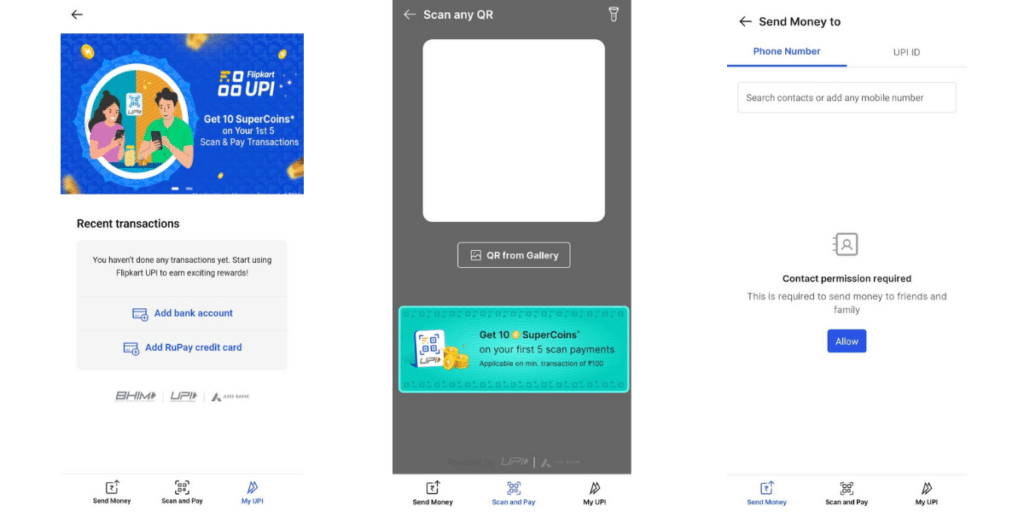

To activate Flipkart UPI and unlock its benefits, follow these straightforward steps:

1. Update your Flipkart app: Ensure you have the latest version installed for optimal functionality.

2. Launch the Flipkart app: Open the Flipkart app and begin the setup process.

3. Locate the ‘Flipkart UPI’ section: Look for the designated banner or menu option within the app. Since this is a new feature the designated UPI section might keep changing in the UI.

4. Link your bank account: Follow the on-screen instructions to setup your account, link your bank account to the Flipkart UPI app as well as choose your UPI ID.

5. Start transacting: Once the setup is complete, you’re ready to enjoy the convenience of making payments and transferring funds through Flipkart UPI.

Flipkart UPI empowers you with a unique “@fkaxis” handle linked to your bank account, similar to those offered by other popular platforms like PhonePe and Google Pay. And now you can avoid the hassle of switching between apps. You can pay for your Flipkart purchases directly within the app using your Flipkart UPI handle or use other UPI features to transact offline and online.

One can also embrace the future of cash-free transactions. Scan QR codes at any merchant accepting UPI, like shops and restaurants, to pay instantly using your Flipkart UPI handle. Also, it is easy to manage your bills and you can pay your utility bills and recharge your phone directly using Flipkart UPI, eliminating the need for separate bill payment apps.

Why did Flipkart launch a UPI Product?

Flipkart’s foray into the UPI space presents two key strategic advantages. First, Flipkart UPI lessens its dependence on external payment processors like PhonePe, Google Pay, and Paytm. This not only reduces transaction fees associated with these platforms but also grants Flipkart greater control over the user experience within its ecosystem.

Users can easily navigate the entire purchase journey, from browsing Flipkart to checkout – without switching between different apps. Integrating UPI directly within the Flipkart app can lead to increased user satisfaction and engagement, providing a more streamlined and convenient experience for users. Flipkart’s UPI service expands the payment options beyond the Flipkart platform. In addition to seamless in-app purchases, you can utilize it for bill payments, recharges, and general payments through QR code scanning.

Additionally, by offering its own UPI service, Flipkart can potentially gain valuable data and insights into user spending habits and preferences. This data can be leveraged to personalize product recommendations, offer targeted promotions, and further refine the user experience within the Flipkart ecosystem.

The timing of Flipkart’s UPI launch comes amid a digital adoption in India, with more users resorting to online transactions for their convenience. Do note, that an iOS release is on the cards, but it is yet to be announced exactly when we can expect the Flipkart UPI app to make its way to iPhones. Furthermore, the credit limit for Flipkart UPI is yet to be disclosed, so we will have to wait for the same.

Also Read: How To Close A Paytm Payment Bank Account: A Step-By-Step Guide

Can Flipkart UPI be successful after the end of Paytm Payments Bank?

This move also comes at an opportune moment. The recent scrutiny faced by Paytm Payments Bank by the Reserve Bank of India (RBI) has created a gap in the market, providing an opportunity for other players like Flipkart to gain a foothold in the digital payments space. By leveraging their existing user base and brand recognition, Flipkart can potentially capture a significant share of the market in the coming years.

Flipkart UPI Launch Offers

To incentivize the use of Flipkart UPI, Flipkart is offering various benefits like supercoins, cashback, and vouchers. Notably, you can earn ten supercoins on your initial five scans and transactions exceeding Rs. 100, and even enjoy a flat Rs. 25 discount on your first Flipkart order using the service.

Also Read: Best Paytm Payment Bank Alternatives

Sell old mobile phone and use the cash to upgrade to a better one. You can get your old phone picked up right from your doorstep and get best price for it. Avail some of the best deals Cashify has. Sell old phone and buy refurbished mobile phone right away!