Are you a Paytm bank account holder who wants to close it but doesn’t know how to close a Paytm payment bank account? Don’t worry! We have a comprehensive guide to address all your concerns and step-by-step instructions to follow.

So, without further ado, let’s dive in!

However, before deep diving into how to close a Paytm bank account, let us first understand what a Paytm payment bank account is and why people are closing it.

Also read: Best Paytm Payment Bank Alternatives

What is a Paytm payment bank account?

It is a digital savings account that you can open without any account opening charges or minimal balance requirements.

Also read: Instant Paytm Cash Earning App You Should Know About

Why are people closing Paytm payment bank accounts?

Recently, RBI banned Paytm payment bank accounts due to persistent non-compliance, and that’s why many people want to close their accounts before March 15, 2024. Yes! You read it right. RBI gave this date as the deadline to close the existing accounts.

However, do you know what is the best part of this?

Read on to know.

Closing the existing Paytm bank account will not affect FASTag, Paytm Wallet, Paytm Money, and many other company services.

However, after March 15, 2024, no further top-ups or funding will be allowed. You can use your existing balance even after March 15, 2024.

Things you need to keep handy before you begin

Before you close your existing Paytm payment bank account, you need to keep a few things handy.

- Make sure you have zero balance in your account. If you have some remaining amount in your account, you can either spend it, transfer it to another Paytm user, or transfer it to another bank account.

- You should keep proof of your ID, such as a PAN card, Aadhaar card, and any registered mobile number handy.

- You must have an active internet connection.

- Ensure you have your KYC updated.

Also read: Make Google Pay, PhonePe, PayTm UPI Payments Without Internet: Step-By-Step Guide

Steps to close the Paytm payment bank account

Here are the steps that you need to follow to close the Paytm payment bank account.

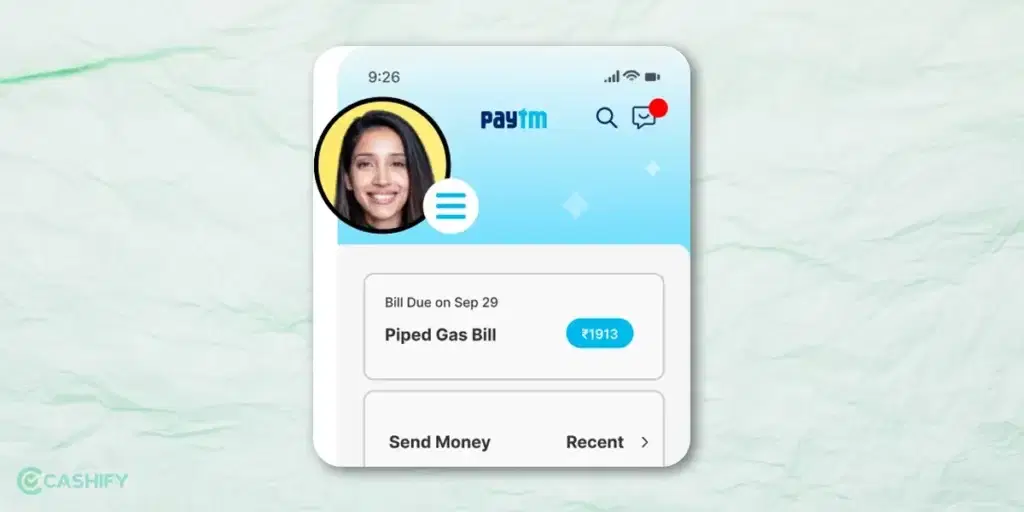

- First, launch the Paytm app on your smartphone.

- After that, you need to go to your profile section by clicking on your profile pic.

- Click on the Bank Section, which you can see in the bottom menu bar of the application.

- After that, you need to enter the four-digit PIN that you have used to safeguard your bank section.

- Now, swipe right and open the Paytm menu.

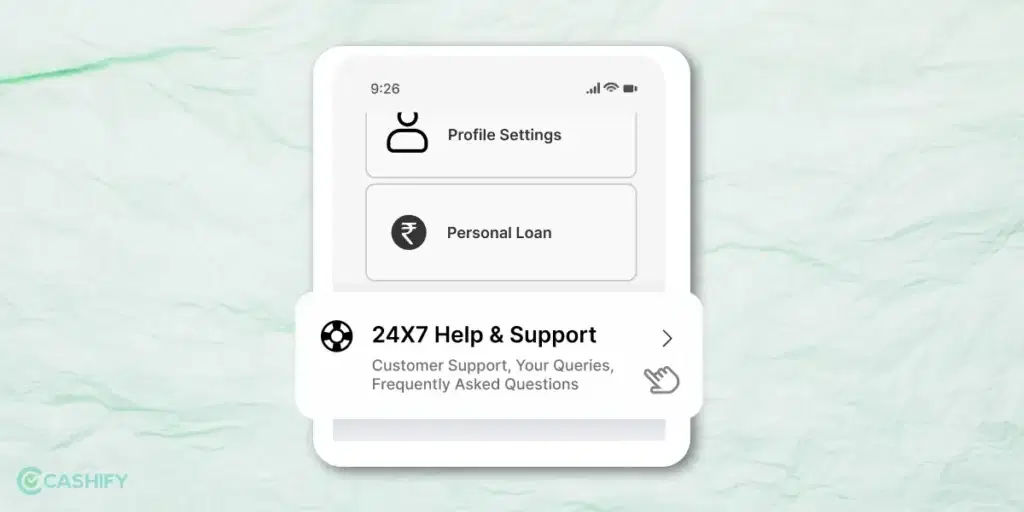

- Click on the 24*7 Help section.

Also read: Circle To Search: Experience The Lightning-Fast Search Results On Android

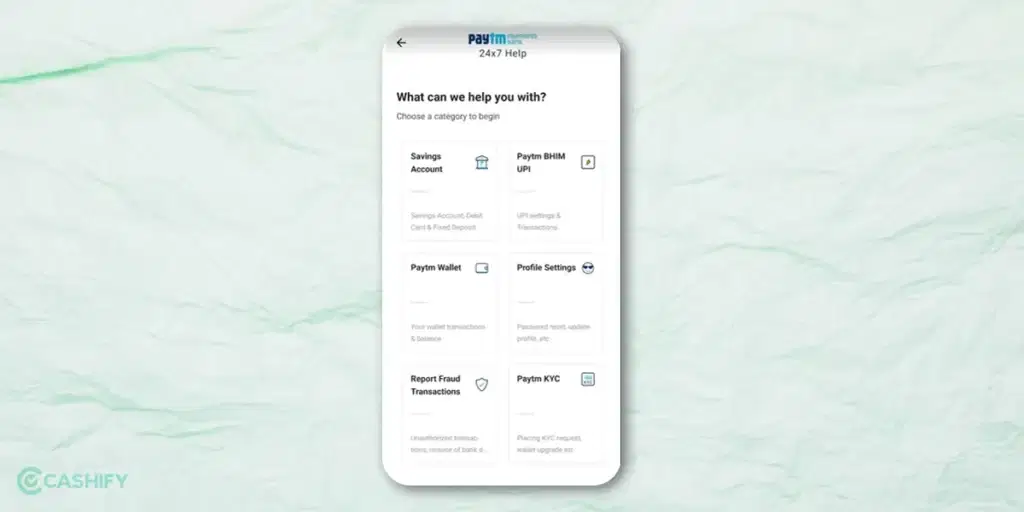

- Then click on Saving Account.

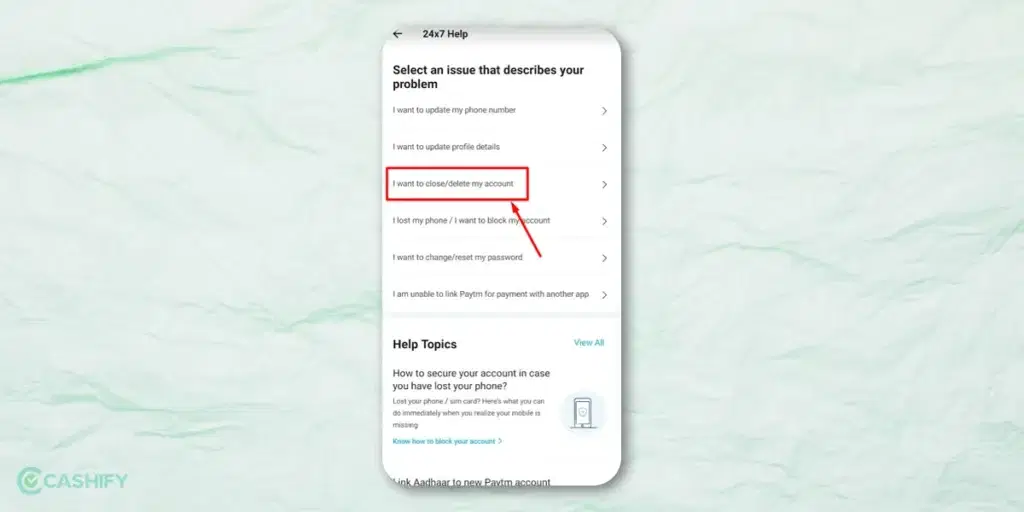

- Now, from the 24*7 Help screen, choose “I want to close/delete my account.”

- You can see the information about Paytm Saving Account in the new screen. After that, click on Confirm.

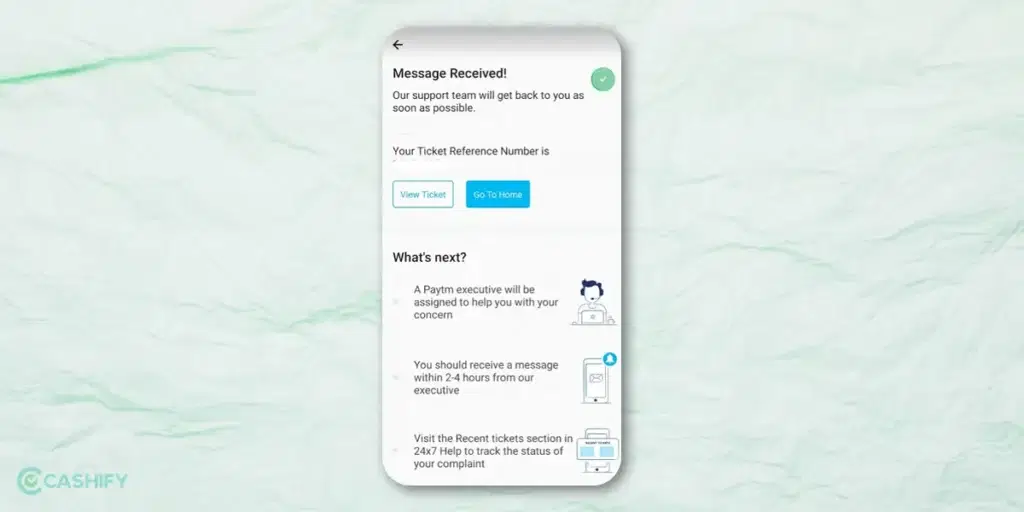

- Now, you can see the Ticket Number for further reference.

- In the next step, you will get a call from the Payment Bank executive regarding closing the Paytm bank account.

- Remember that you need to inform them to close only your savings account.

- Once you confirm, your account will be closed within four hours.

Also read: Best UPI Apps For Safe Online Payments

FAQs

Q. Will I be able to transfer or withdraw money from my current or savings account?

A. As per the RBI statement, if you are a Paytm payment bank account holder, you can withdraw or transfer funds from the account even after March 15, 2024.

Q. Do I need to pay any charges to close my Paytm payment bank account?

A. No, you don’t need to pay anything to close your account. It will only cost you precious time.

Also read: What Is UPI Lite? Key Features, Advantages, And Everything You Need To Know

Q. What will happen to Paytm Wallet?

A. According to the RBI statement, users can withdraw or transfer to another bank account or wallet till the balance is available in the wallet. Besides, after March 15, 2024, users will not be able to transfer the money or top-up into their wallet. They will only be able to receive cashback and refunds in the Paytm Wallet.

Q. My salary and EMI are linked with my Paytm payment bank account. What will happen to them?

A. You will not be able to receive the salary into the account after March 15, 2024. However, it would be best to make alternative arrangements with the other bank. So you don’t have to face the inconvenience.

Regarding EMIs, the auto-debit will continue until you have a balance in your account. After March 15, 2024, no credit or deposit in the account will be allowed.

Also read: Activate UPI Using Aadhar Using These Easy Steps!

Concluding Remarks

That’s it! Hopefully, this article helped you understand how to close a Paytm payment bank account. It is a straightforward process. All you need to do is follow the above-discussed steps to close your existing account quickly and easily. Still, you can ask us in the comment section below if you have any other queries.

Also read: How To Send Money From PhonePe To Google Pay?

Buying refurbished mobile phones was never this easy. Sell your old phone and get exclusive offers & discounts on refurbished mobiles. Every refurbished phone is put through 32-point quality checks to ensure like-new standards and comes with a six-month warranty and 15-day refund. Buy refurbished phone easily on no-cost EMI today!