Getting a personal loan is one of the best ways to manage financial emergencies without spending your savings. The best loan apps can help you get an instant loan to fulfill your goals in life. These apps process loans faster than banks with minimal documentation. If you take a loan from a bank, the entire process is time-consuming and lengthy.

Therefore, when you face unexpected expenses like medical bills, are short on funds, or have educational fees, these apps can streamline the process with quick processing times and minimal paperwork.

However, if you are struggling to decide which personal loan app to choose, we have got you covered. In this article, we have listed a few of the best loan apps.

To learn more about it, read on.

Also read: Best Personal Loan Apps For Easy Loan Approvals

Disclaimer: This list of the best loan apps is based solely on the popularity of loan apps in India, and Cashify has no affiliation with them. We suggest you check the respective entity’s official website for up-to-date data.

List Of 5 Best Loan Apps

Don’t waste your valuable time scrolling through various app descriptions to decide which loan app is the best. Here, we have compiled a list of the best loan apps that are flexible and the most convenient.

1. Freo Money

Featuring first on the list is Freo Money. The app has a highly secured interface and API. The best thing about this app is that you need to pay interest on the loan amount you used, not the entire approved amount.

To get an instant loan from this app, follow the steps below.

- First, you need to download the app from Google PlayStore or AppStore.

- After that, you must fill in the required information, such as your city, age, income, PAN, etc.

- This information lets them find out your eligibility for the credit line.

- In the next step, you need to complete KYC, and after that, you can get the funds once you get the necessary approval.

Key Features

| Loan Amount | Up to Rs. 5,00,000 |

| Rate Of Interest | 1.08% – 2.3% per month |

| Additional Fees/Charges | 2% + GST |

| Repayment Tenure | Up to three years |

| Loan Approval Time | Approximately four to five minutes |

| Impressive Feature | No-usage-no-interest |

2. KreditBee

The next on the list is KreditBee. It caters to young professionals who need instant personal loans. The entire loan process of KreditBee is seamless, online, and collateral-free.

You can apply for the loan through its official website or app. You don’t need to go through the lengthy documentation process. The loan will be disbursed in just 10 minutes.

Click here to download the Android and iOS app.

Key Highlights

| Loan Amount | Rs. 3000 to Rs. 5,00,000 |

| Rate Of Interest | 5% – 29.95% per year |

| Repayment Tenure | Three months – 24 months for a salaried personal loan |

| Loan Approval Time | 10 minutes |

| Impressive Feature | 100% online process, collateral-free |

Also read: How To Take EMI On Cashify?

3. PaySense

Up next on the list is PaySense. This app offers personal loans to the salaried and self-employed person in order to fulfil their financial needs. PaySense has partnered with top financial institutions and banks to provide instant personal loans. This app is popular for its transparent pricing, advanced credit scoring algorithm, and consumer satisfaction. To download the Android app, click here.

Key Highlights

| Loan Amount | Rs. 5,000 to Rs. 5,00,000 |

| Rate Of Interest | 1.4% to 2.3% per month |

| Additional Fees/Charges | Processing fees of 3% of the loan amount |

| Repayment Tenure | Three months – 60 months |

| Loan Approval Time | Quick, within minutes |

| Impressive Feature | Offer loans to people who don’t have a credit record or have never taken a loan before. |

Also read: Best Paytm Payment Bank Alternatives

4. CASHe

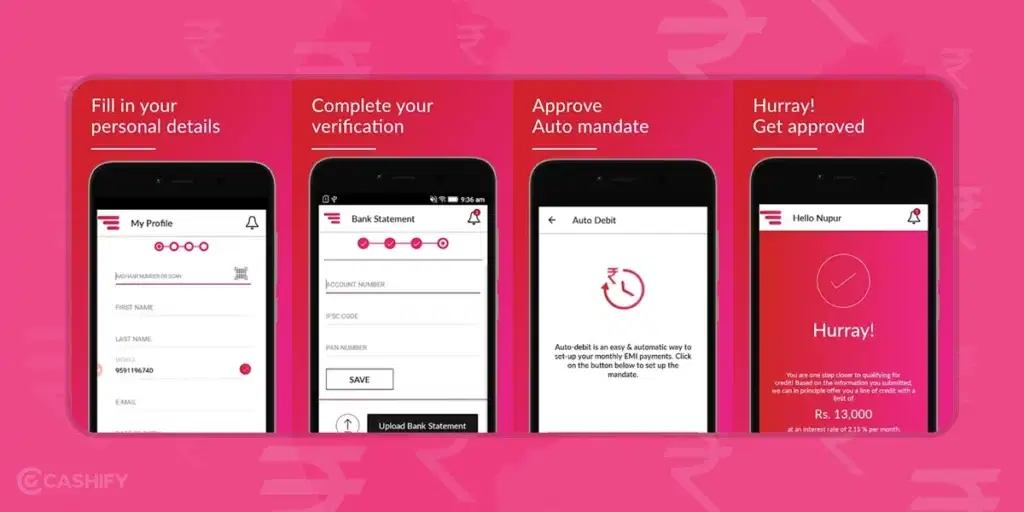

The next on the list is CASHe. It is a digital lending company that provides short-term personal loans to salaried persons. It has a user-friendly interface. With this app, users can get a single approval for multiple loans. If you want to apply for the loan, before applying for the loan, you need to follow the below steps.

- First, upload the necessary documents.

- Complete the verification process.

- Set the limits for the loan.

- Once you complete all these steps, the app will directly disburse the money to your bank account.

- If you want hassle-free repayment, set an auto debit facility for the bank account.

Keep in mind that if you want to avail of a personal loan from the CASHe, you must have a decent credit score. Here is the link to download the Android and iOS app.

Key Highlights

| Loan Amount | Rs. 5,000 – Rs. 4,00,000 |

| Rate Of Interest | 15% to 35.03% |

| Additional Fees/Charges | 2% + GST |

| Repayment Tenure | Two months – 48 months |

| Loan Approval Time | Instant |

| Impressive Feature | You can instantly withdraw the money from the available credit limit. Collateral-free approach |

Also read: Best UPI Apps For Safe Online Payments

4. NIRA

It is one of the best loan apps in India that is making waves in the Indian financial industry. If you have a low or no credit score, then this app is the perfect pick for you when you need a personal loan. Its registration process is quite simple.

You can set the auto credit and auto-debits. The best feature of this app is that you need to pay interest for the amount you have used, not for the entire approved amount.

Here is the link to download this app – Android, iOS

Key Highlights

| Loan Amount | Up to Rs. 1,00,000 |

| Rate Of Interest | 2% per month |

| Additional Fees/Charges | 2% + GST |

| Repayment Tenure | Up to 12 months |

| Loan Approval Time | Three minutes |

| Impressive Feature | Loans without a credit score, no-usage-no-interest |

5. IndiaLends

Last but not least, one of the best loan apps is IndiaLends. If you want a customised loan option, this app is the perfect pick for you. The app offers instant loan approval and disbursal.

You need to follow the steps below to avail a personal loan.

- First, you need to compare various offers.

- After that, select the one with the lowest interest rates + processing fees.

- Now, fill out the form with the required details.

- In the next section, you need to sign the agreement.

- It’s done! The loan amount will be credited to your bank account.

If you want to download this app, click here – iOS.

Key Highlights

| Loan Amount | Rs. 35,000 – Rs. 5,00,000 |

| Rate Of Interest | 13% to 24.03% |

| Additional Fees/Charges | Up to 2% + GST |

| Repayment Tenure | Two months – sixty months |

| Loan Approval Time | Instant |

| Impressive Feature | You can compare various offers from the 70+ RBI-approved lenders. |

Also read: What Is UPI Lite? Key Features, Advantages, And Everything You Need To Know

Signing Off

In summary, these best loan apps can be life saviors in emergencies. Therefore, no need to worry if you are facing a fund shortage or don’t want to borrow money from friends and family. These apps can be your helping hand. Therefore, choose the app that perfectly meets your financial needs and simplifies the loan-taking process.

Also read: Using UPI App? 8 Safety Tips You Must Follow

If you’ve just bought a new phone and don’t know what to do with your old phone, then here’s your answer. Sell old mobile to Cashify and get the best price for it. If you are planning to buy a new phone, check out Cashify’s refurbished mobile phones. You can get your favourite phone at almost half price with 6-month warranty, 15 days refund and free delivery.