Digital currencies, especially cryptocurrency have taken over the globe in recent times. Exponential growth has been witnessed in the number of people investing and trading in crypto.

The basic idea behind trading crypto is to buy or invest in coins and sell them for profit when the right time arrives. This might sound very simple while starting, but it becomes difficult as one starts understanding the risks and complexity involved.

Also Read: 10 Most Expensive NFTs Ever Sold

How to Start Crypto Trading

First of all, you need to sign up for a crypto exchange service such as Coinswitch Kuber, Binance, CoinDCX or WazirX. Each app or exchange website is very well designed for new users.

After installing one of the apps, open an account with the broker. A bunch of information such as your name, date of birth, address etc. will be required to complete the KYC process.

When the registration process ends, link your bank account to the crypto brokerage to fund your account. You may use your Debit/Credit card, UPI or Net banking to transfer money.

Once your account is funded with a reasonable amount, you can now start trading. To begin with, pick and research various cryptocurrencies to invest in. You can visit websites like CoinMarketCap (coinmarketcap.com/coins/) to get a list of the safest options available in the market. One also needs to take extreme precautions before investing in poop coins like ShibaINU, Dogecoin, etc. These coins do not have strong fundamentals but are trending in recent times. Thus, these coins are not good for a long-term hold, especially for beginners.

Once you have decided which coins are the best to invest in, the next section lays down the basic fundamentals of trading.

Also Read: Best Crypto Research Site You Must Check Before Investing

Types of Trading Strategies

Once you have decided which coins are the best to invest in. You will now have to start trading them using different strategies. One can choose a style that suits them, or one can mix and match styles based on the asset or their goals.

People who are new to crypto trading might not realize soon which style suits them the best. Thus, they can try each strategy by themselves starting with small investments. Once you have tried out all of the methods, introspect which of them was the best aligned to your goals & patience level.

Some of the most common trading strategies are:

Scalping: It involves the rapid trading of cryptocurrencies every few minutes or hours. This strategy requires full focus from the trader. The profit margins are lesser per trade, but more trades per day can ensure a constant stream of passive income. This strategy is also helpful to cut down losses since you can sell assets as soon as their value starts dropping. This requires risk management and quick decision-making skills.

Day trading: This style is quite similar to scalping, except that you will be making trades over a day, instead of every few minutes. This type of trading strategy can yield good profits in the long run, when traders take it seriously and do their technical analysis without fail. Day traders invest small amounts at a time, just like scalpers. But, one should avoid scam or meme coins since they are often illiquid, and the chances of their value getting exponentially increased are bleak.

Range trading: It is an active investing strategy that identifies a range at which the investor buys and sells crypto over a short period. Unlike scalping/day trading, it requires great experience and timing to predict whether a particular crypto will trade between the expected range or not. Range trading can result in losses if the price does not move in the direction you anticipate over your clock.

Intraday trading: It is an extended form of day trading, wherein traders can hold a specific position for more than a day. One can switch between day trading and intraday trading as per the market requirements. Although Crypto markets are 24*7, day trading here signifies a full trading day in reference to the trader. In the end, the time for which you hold on to a certain position doesn’t matter as long as you’re making good profits.

Swing Trading: The idea behind swing trading is to analyze and grasp the swings in the crypto market that take place over a few days to several weeks. Swing trading is a commonly used trading strategy that can be ideal for beginner traders. It is a much less stressful and comparatively inactive strategy than scalping and day trading. Since swing traders make larger trades in terms of volume, they can bring in sizable returns from even just a few winning trades.

Position trading: Position trading lies somewhere in between swing trading and investing. It is a trading style where the investor holds a position (long or short) for a very long period. This period might vary from a few weeks to even years. It increases the chances of getting better profits compared to other styles. This is due to the flexibility it provides to capture larger price movements on a percentage basis. Therefore, providing more potential for profit in the long term. However, one needs to invest a large amount into position trading to get significant returns in the future.

Also Read: Best Cryptocurrencies To Watch Out For Long Term Investment

How To Trade Cryptocurrencies

There are various aspects behind trading cryptocurrencies. Let’s take a look at some of the most important ones.

Spot trading is a way of trading digital assets in which one buys a certain amount of crypto coins and waits for the price to pump gradually. When the traders anticipate profit in selling them later, they hold their position on the spot till the right time arrives. Since most crypto coins are expected to eventually go up in value, patient traders generally make good profits.

The current price of a particular cryptocurrency is called the spot price. All traders can immediately sell their assets at this price. The spot price keeps fluctuating as trades take place. The trade initiates the exchange of crypto and records the transaction on the blockchain and the exchange marks the order in its own order book as well. The traded assets which are transferred are received by the buyer immediately in the respective wallet.

How to trade Bitcoin on Binance: An Example

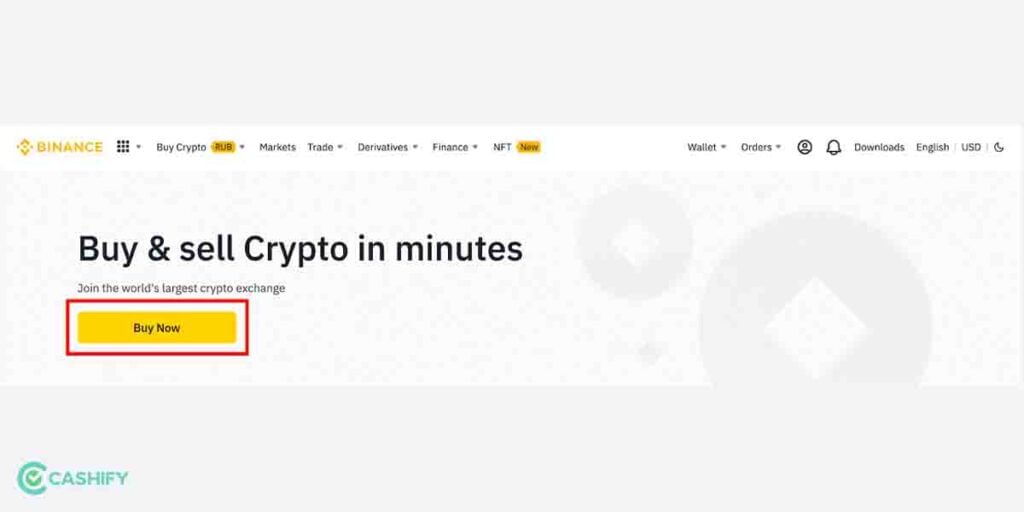

- Complete the installation and registration process on the Binance website/app as mentioned earlier in this guide.

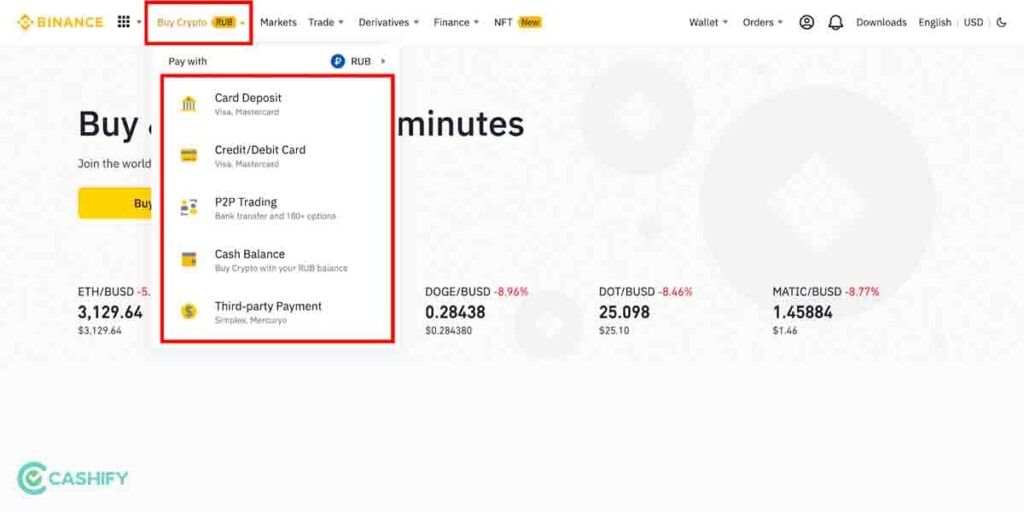

- Click on the buy now option.

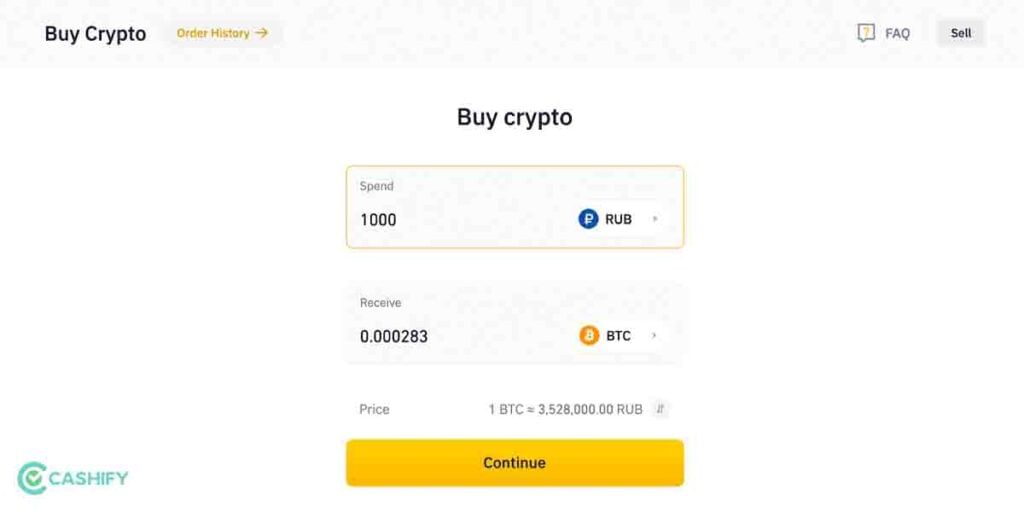

- Select the fiat currency which you would exchange for the cryptocurrency. Enter the amount of that currency that you are willing to buy assets.

- In the ‘Receive’ box, select Bitcoin. The number of bitcoins corresponding to the fiat currency that you entered will be shown.

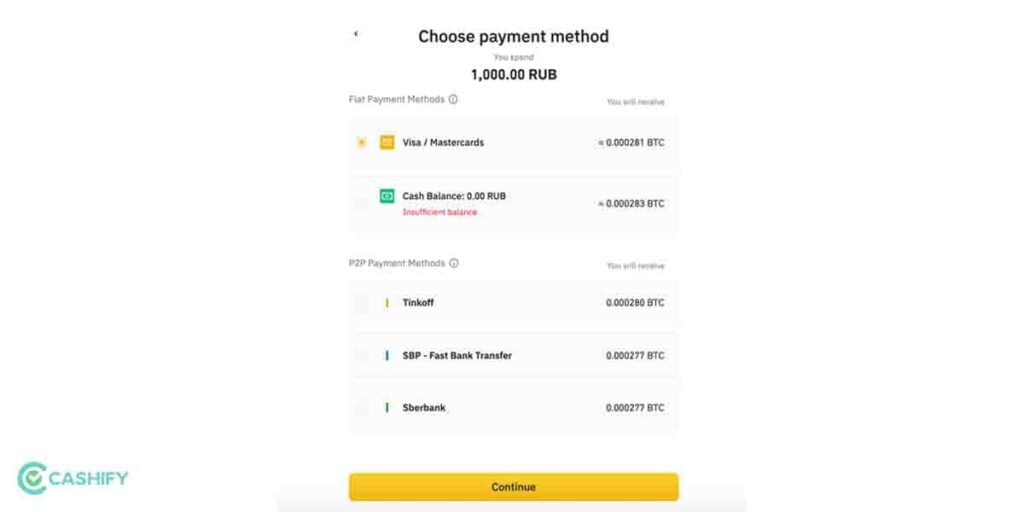

- Click on the continue button to proceed to the payment window. Select your preferred payment method and enter the details as asked by Binance.

- Click on the Confirm button after reading the note and ticking the ‘Terms & Conditions’ box.

- Now, you will be redirected to the bank’s payment page where you have to proceed as instructed. Follow the on-screen instructions to verify the payment.

- Check your Binance wallet to confirm whether your transaction has been completed successfully or not.

Now that you own a digital currency, the next step is to wait for the right time. Keep a constant check on the crypto currency’s market value. As soon as you see a jump in the prices and your target price is reached, proceed to sell your assets to earn a profit. This is how you can exercise spot trading.

Also Read: How To Do Cryptocurrency Mining In India? A Complete Guide

Orders and their Types

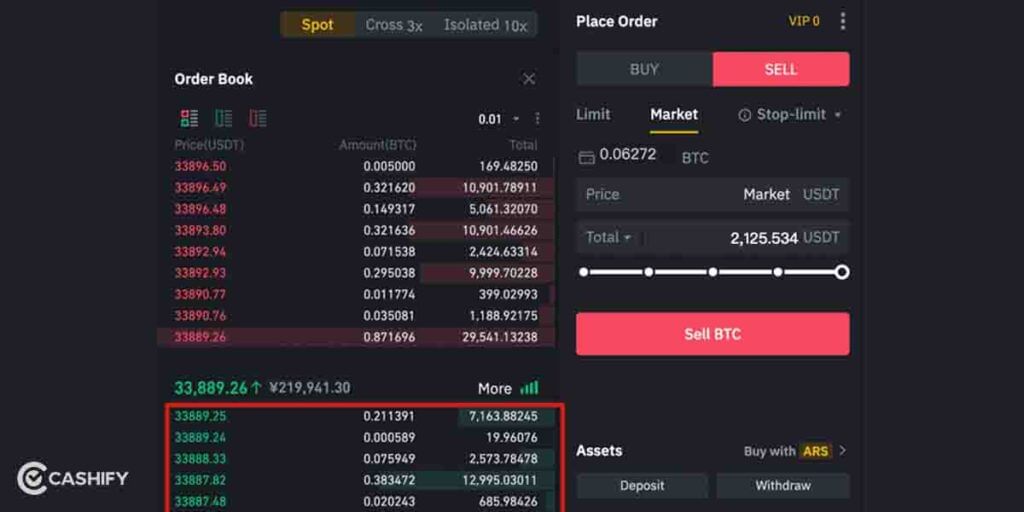

While trading crypto, ordering assets is the first and foremost task. The Bitcoins bought in the example above were also a kind of order. Every instruction that you give to the Broker/Exchange ( like Binance) to buy or sell an asset is an order. The most important types of orders that a new trader must know are ‘Market Order’ and ‘Limit Order’.

Market Order: Market orders are transactions which are to be executed as quickly as possible at the current market price. For example, on Binance, you can buy bitcoin by entering the quantity of cryptocurrency you are willing to buy. And the corresponding amount of Fiat or USDT/BUSD value will be display which can be used to purchase bitcoin.

If the current price of the crypto is some amount, say X, your order will be filled with the best available price to match the order book immediately. The average filled price of your order may not be exactly X, but slightly more if you are buying, or slightly lower if you are selling the assets.

Limit order: A limit order lets you define a range of price within which your cryptocurrency will be purchased. It is a safer option than Market order, especially for beginners who haven’t properly analyzed and explored the dynamics of the crypto market. A limit order transaction gets executed only when a particular coin is available to buy for a price equal to or lower than a threshold set by you. Similarly, a limit order can be used to sell your assets at a price equal to or higher than the current market price or an amount set by the trader.

How to Make Profits by Trading Crypto

As a trader, one’s primary goal is to earn as much profit with ease. Find strategies that fit your investment goals whether that be selling a small percentage at a time or keeping your profits in stablecoins.

Here are some important points that you should keep in mind to maximize profits in your trades while bearing the minimum possible losses.

Know When to Sell: There is never the best time to sell your assets. Selling the cryptocurrency in a hurry for small profit gains might look like a good option, but it is quite an inefficient method to trade. Instead, research properly before selling an asset so that the best possible profit can be yielded from your investment.

Reinvest Wisely: After selling your crypto assets, do invest a portion of the profits along with the original amount to increase your portfolio strength. Always sell your crypto assets in portions and keep well-defined target prices since the market is very volatile. Along with this, keep reinvesting in different assets to maximize exposure.

The HODL Strategy: HODL stands for hold on for dear life. This is very important in situations when the prices of your assets drop significantly. When the prices fall, one shouldn’t panic and sell all assets at loss. Instead, it’s better to remain calm and hold to your position until the market recovers in the coming days.

Dollar Cost Averaging: Dollar-cost averaging involves investing the same amount of money in a cryptocurrency at regular intervals over a certain period of time, regardless of price. It reduces your dependency on market timing, such as buying only when prices have already risen.

Also Read: Best Apps To Buy Cryptocurrency In India!