Apple Pay is an incredible useful feature which is a perfect digital wallet solution. It is contactless and tap-to-pay! Apple Pay does not work in India as of February 2026. Indian banks don’t support adding cards to Apple Wallet for contactless payments, and the infrastructure isn’t in place. However, iPhone users have superior alternatives through UPI apps like Google Pay, PhonePe, and Paytm. Apple is reportedly developing a UPI-integrated version that may launch in 2026-2027, bringing Face ID-powered payments to Indian iPhones. Let us know the details below.

Does Apple Pay Currently Work In India?

The short answer is no! Apple Pay does not work in India for card-based payments. You can not add credit or debit cards to your wallet to make contactless payments.

Even if you see the Apple support website, you can see the list of eligible countries and regions that support Apple Pay. India is unfortunately not one of them. Even if you many communities like Quora or Reddit, people say that Indian banking or financial regulations are the reasons it’s not in India for now.

Apple Pay is currently available in 78 countries worldwide, but India is not among them. According to Apple’s official support website, the service works in regions including the United States, United Kingdom, Canada, Australia, Singapore, UAE, and most of Europe—but Indian users remain unable to access the feature.

If you see many wallet apps in India, they are mostly limited to storing passes, tickets, transit cards, and more. You can barely add any debit or credit cards for payments. Let’s explore the reasons why Apple Pay has not yet launched in India.

Reasons Apple Pay Hasn’t Launched In India!

Several intersecting factors explain why Apple Pay hasn’t launched in India:

Banking and Government Rules

India has strict rules for how digital payments should work. This is especially true when it comes to card security, privacy, and authentication. Some of the features Apple Pay uses don’t match these Indian rules. India’s homegrown RuPay network (which accounts for 65% of debit cards issued) operates differently from international networks like Visa and Mastercard that Apple Pay traditionally supports.

Banks Not Ready Yet

Apple Pay need to partner with Indian banks and other payment companies. So far, these partnerships haven’t fully happened. India also uses different types of card networks. We use RuPay instead of the international ones Apple usually works with. This makes it harder for Apple Pay to fit in.

India Already Has UPI

UPI is already super popular in India. People use it to make payments, scanning QR codes, and more. This is done all without needing credit or debit cards. Because UPI works so well, there’s less need for Apple Pay. Indian regulators prefer to use homegrown systems like UPI for security and cost reasons.

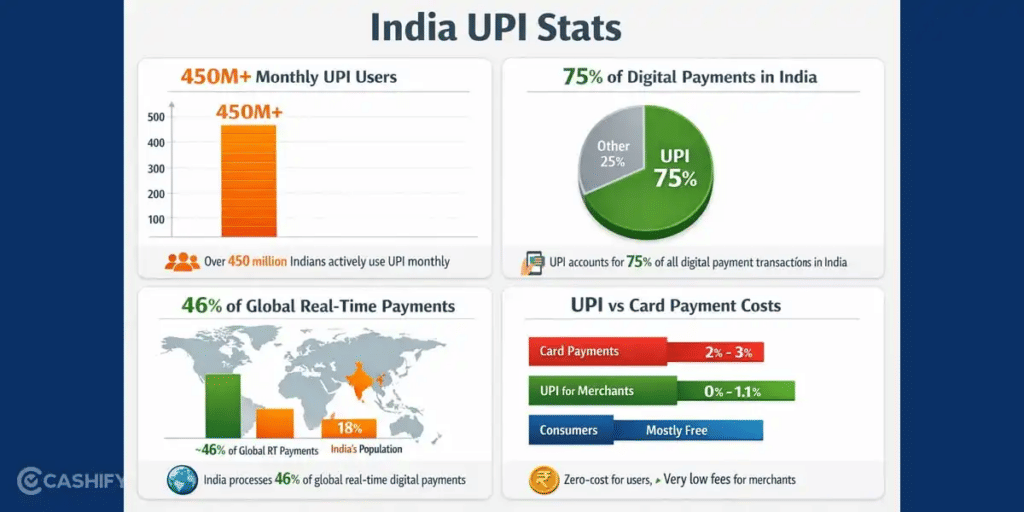

- Over 450 million Indians actively use UPI monthly

- UPI accounts for 75% of all digital payment transactions in India

- India processes 46% of global real-time digital payments, despite representing only 18% of the world’s population

- UPI transactions are free for consumers and extremely low-cost for merchants (typically 0-1.1% vs. 2-3% for card payments)

India already has strong digital payment systems like UPI. Plus, Apple still needs to work out rules and bank partnerships.

Apple Pay vs Indian Payment Methods: Complete Comparison

| Feature | Apple Pay (Global) | UPI (India) | Indian Digital Wallets |

|---|---|---|---|

| Availability in India | Not Available | Fully Available | Available |

| Device Requirement | iPhone 6+ / Apple Watch | Any smartphone | Any smartphone |

| Transaction Limit | Varies by bank (typically ₹5,000-₹10,000 per tap) | ₹1,00,000 per transaction | ₹10,000-₹1,00,000 |

| Authentication Method | Face ID / Touch ID | UPI PIN + Device Binding | PIN / OTP / Biometric |

| Merchant Acceptance | Limited (requires NFC terminals) | 99%+ (QR codes everywhere) | 80%+ (online and offline) |

| Transaction Fees | Bank-dependent (0-2%) | Free for consumers | Usually free |

| Infrastructure Required | Expensive NFC terminals (₹15,000-₹50,000) | Printed QR code (free-₹100) | Internet connection only |

| Works Offline | No | No | Limited (stored wallet balance) |

| Peer-to-Peer Payments | Apple Cash (US only) | Yes (instant, free) | Yes |

| International Usage | Yes (78 countries) | Limited (select countries only) | Limited |

| Security | Tokenization + Biometric | Two-factor (UPI PIN + device) | Varies (PIN/OTP/biometric) |

Is There Any “Way Around” To Enable Apple Pay in India?

Because Apple Pay is not officially supported, there is no legitimate way to make full Apple Pay work with Indian-issued cards or merchants. Any method that claims to “hack” or “enable” it would likely violate terms of service. So always be careful be with it.

However, this is what you can try instead:

Use a foreign bank/card (in a country where Apple Pay is supported)

If you hold a bank account or card in a country where Apple Pay is supported, you can use Apple Pay with it. You can add that card to your Apple Wallet and use it where Apple Pay is accepted abroad.

- Limited acceptance in India: Most Indian merchants don’t have NFC terminals or don’t accept international contactless payments

- Foreign transaction fees: You’ll pay 2-3.5% foreign exchange markup plus GST on every transaction

- Currency conversion losses: Your spending will be converted from INR to your card’s currency at unfavorable rates

- Compliance issues: Using foreign cards for regular domestic transactions may violate FEMA (Foreign Exchange Management Act) regulations

But in India, many won’t accept NFC payments via Apple Pay or may not validate foreign cards easily. You also have to be careful if you are using foreign cards, as they may incur foreign exchange charges.

Jailbreaking or Region Manipulation

Some tech forums suggest jailbreaking iPhones or changing region settings to trick iOS into allowing card additions. This approach is:

- Insecure: Jailbreaking removes Apple’s security protections, exposing your device to malware

- Warranty-voiding: Apple will refuse service on jailbroken devices

- Ineffective: Even if you bypass the software check, Indian banks won’t provision cards to Apple Wallet, and merchants won’t accept the payments

- Data risk: You could expose sensitive financial information

Verdict: Dangerous and ultimately futile. Never attempt this.

Wait for Apple/banks to roll it out

A more practical “way around” is to monitor announcements. If Apple negotiates with Indian banks and regulators, it could launch Apple Pay in India in the future. Many users hope for that. You can also check Apple Support Community for additional and updated details.

Top Alternatives For Apple Pay In India

Since Apple Pay isn’t available, here are alternatives:

UPI / UPI apps

This is the most popular mode of digital payments in India. UPI processed a record 13.44 billion transactions worth ₹18.42 lakh crore, reinforcing its position as the world’s largest real-time payment system. You can use apps like Google Pay, PhonePe, Paytm, etc. UPI supports peer-to-merchant, QR code payments, etc.

Bank apps/card apps

Many banks offer their own mobile apps where you can manage and pay using their cards or do bank transfers directly.

Wallet apps/e-wallets

Apps like Paytm, Mobikwik, Amazon Pay, etc., allow you to load money and use it for purchases. Note that these have limitations (transaction caps, withdraw limit, etc.).

Card + contactless / NFC payments

Even though Apple Pay isn’t active, some merchants accept contactless card taps (Visa contactless, Mastercard Pay Wave) if you physically have the card. That’s separate from Apple Pay but still a tap-based method.

How Long Do We Have To Wait For Apple Pay In India?

It’s uncertain, but possible. This depends on how the legal, regulatory, and banking cooperation evolves. Nevertheless, Apple Pay isn’t coming to India at least this year. Keep visiting this space for more details:

Apple has expanded Apple Pay gradually across many countries; India is a large market. It’s likely present in their roadmap even though we do not know anything about the timeline.

Rumours Of UPI-Based Apple Pay For iPhone In India

Apple Pay is not officially available in India right now. But there are many rumours that Apple might be working on a special Indian version of it. Instead of using credit or debit cards like in other countries, this version might work with UPI.

Here are all the details:

Apple Is Talking to Indian authorities

Some reports indicate that Apple has resumed discussions with NPCI and Indian regulators. The goal is to make a system where iPhone users can pay using UPI directly from their phones.

UPI-based version instead of cards

In other countries, Apple Pay connects your credit or debit cards to your phone. But in India, it might work differently. Here, users can scan QR codes or make UPI transfers directly, eliminating the need for extra apps.

Face ID for UPI payments

Another rumour suggests that Apple may enable users to verify UPI payments using Face ID or Touch ID. This means you could scan a QR code and pay using your face or fingerprint.

Pay directly from Wallet or Camera

Some reports also suggest that Apple wants to let users scan a QR code and pay directly from the iPhone’s Wallet app or camera. If this is try, there won’t be any need to open Google Pay, PhonePe, or other apps.

There’s no official launch date for this. Apple has not confirmed which banks or partners it’s working with.

Why UPI-Based Apple Pay Makes Sense

There are a few reasons why this idea actually fits India very well:

- Everyone uses UPI in India. If Apple builds on top of that, it can easily connect with what people already use.

- Instead of building an entirely new system, Apple can just use UPI’s existing network.

- With Face ID or Touch ID, UPI payments on iPhone could become even more safe and easy.

- Working with UPI means Apple won’t face big issues with Indian laws or the RBI.

FAQ On Apple Pay In India

When will Apple Pay launch in India?

No official date announced. Industry estimates suggest 2027-2028 for a UPI-integrated version. Apple is reportedly in talks with NPCI, but regulatory approvals and bank partnerships take 12-24 months minimum.

Can I pay using Apple Watch in India?

No. Apple Watch requires Apple Pay to be active in your region. Since Apple Pay doesn’t work in India, Apple Watch cannot make payments. You’ll need to use your iPhone with UPI apps.

Is there a petition to bring Apple Pay to India?

Multiple user petitions exist on forums and social media, but Apple’s decisions are based on business viability, regulatory approvals, and bank partnerships—not petitions. The best way to show demand is by engaging with official Apple India feedback channels.

Can I use Apple Pay in India with a foreign card?

A: Technically yes, but it’s impractical. Most Indian merchants don’t have NFC terminals, and you’ll pay 2-3.5% foreign transaction fees plus currency conversion charges on every purchase. For residents, UPI apps are far better.

Which iPhones support Apple Pay?

iPhone 6 and all newer models (6s, 7, 8, X, 11, 12, 13, 14, 15, 16, 17 series) support Apple Pay. Apple Watch Series 1 and later also work. However, the feature isn’t active in India yet.

Will Apple Pay replace UPI in India?

No. UPI is too dominant (13+ billion monthly transactions) and works on all smartphones. Apple Pay will likely integrate WITH UPI rather than compete against it, offering Face ID authentication for UPI payments.

Can Android users access Apple Pay?

No. Apple Pay is exclusive to Apple devices (iPhone, iPad, Apple Watch, Mac). Android users can use Google Pay, Samsung Pay, PhonePe, or Paytm instead.

How much does Apple Pay cost to use?

Apple Pay is completely free for users—no subscription or transaction fees. In India, if it launches with UPI integration, it will remain free since UPI is a zero-cost system.

What’s the transaction limit for Apple Pay?

Varies by country (₹5,000-₹10,000 typically for contactless). In India, if launched with UPI, the limit would be ₹1,00,000 per transaction (standard UPI limit), adjustable in settings.

Do I need internet to use Apple Pay?

For contactless in-store payments (globally): No internet needed at the moment of tap. For India’s rumored UPI version: Yes, internet required since UPI is a real-time online system.

Will Face ID work for UPI payments?

Not yet, but it’s rumored. Apple is reportedly developing Face ID authentication for UPI transactions, replacing manual PIN entry. This feature may launch with Apple Pay’s India version in 2026-2027.

Can I add Indian cards to Apple Wallet?

No, not for payments. You can only store boarding passes, event tickets, loyalty cards, and transit cards in Apple Wallet. Credit/debit cards from Indian banks cannot be added.

Does Apple Pay work at Indian stores?

No. Even if you have Apple Pay set up with a foreign card, most Indian merchants don’t have NFC payment terminals. Only premium retailers in major cities accept contactless payments.

Conclusion

Apple Pay remains officially unavailable in India as of February 2026, with no confirmed launch date. Indian iPhone users cannot add domestic credit or debit cards to Apple Wallet for contactless payments. The combination of regulatory complexities, limited bank partnerships, and UPI’s overwhelming dominance has prevented Apple Pay’s traditional model from entering the Indian market.

However, India’s digital payment ecosystem is among the world’s most advanced. UPI provides superior functionality, universal merchant acceptance, zero-cost transactions, and instant settlements—advantages that even Apple Pay struggles to match in markets where it operates.

If you’ve just bought a new phone and don’t know what to do with your old phone, then here’s your answer. Sell old mobile to Cashify and get the best price for it. If you are planning to buy a new phone, check out Cashify’s refurbished mobile phones. You can get your favourite phone at almost half price with six-month warranty, 15 days refund and free delivery.