In 2022, NCPI introduced UPI Lite to ease the digital payment experience. However, if you don’t know much about what is UPI Lite and how to enable it, this article is for you.

This article will shed light on how UPI Lite works, its security, its features, how to transfer funds through it, and much more.

So, keep reading.

Also read: Activate UPI Using Aadhar Using These Easy Steps!

What is UPI Lite?

It is an on-device wallet. It lets you pay using their on-device wallet instead of a linked bank account. For that, you need to add money to your preferred platform, such as Paytm or BHIM wallet, and you are good for doing transactions through UPI Lite. Using it, you can do instant transactions of up to ₹ 200 without any UPI PIN.

You can add a maximum ₹ 2,000 twice a day to UPI Lite, which will allow you to use up to ₹ 4,000 per day. When you use UPI Lite, you don’t need to worry about the daily UPI transaction limit on the bank transactions. It means you can make multiple small-value UPI payments.

Also read: 6 Best UPI Apps For Safe Online Payments

Key Features – UPI Lite

Here are a few key features of UPI Lite.

- Using it, you can pay up to ₹ 200 without entering any UPI PIN.

- You can add ₹ 2,000 twice a day to it. This money will be added using UPI, your UPI account, instead of a credit/debit card.

- Whatever payment you have made through UPI Lite will be credited to the beneficiary’s bank account straight. It will not credited to their UPI Lite wallet.

- When normal UPI does not work correctly because of load at that time, UPI Lite works fine. This is because UPI Lite does not count on UPI Infrastructure to make the payment.

- Paying through UPI Lite will keep your bank account statement clutter-free, as all UPI Lite transactions will be recorded in the app, not in your bank statement.

- You cannot activate UPI Lite for multiple bank accounts in an app.

- The best thing about UPI Lite is that you can withdraw money anytime without any additional charges.

UPI Lite – Working

It works the same as other wallets. To initiate UPI Lite, you need to add money to it. You can add up to ₹ 2,000 twice a day through your UPI account. when the payment is credited to your UPI Lite wallet you are good to go .

You can do small transactions of up to ₹ 200 by scanning a QR code or entering the phone number. The money will be transferred to the recipient’s UPI account. UPI Lite moves the core transactions from the bank to the app.

Also read: Using UPI App? 8 Safety Tips You Must Follow

Let’s Understand the Difference – UPI Vs. UPI Lite

To better understand the UPI Lite, let’s check out a few differences between UPI and UPI Lite.

| UPI | UPI Lite |

| It is made on IMPS. Through UPI, you can transfer money from one bank account to another. | An on-device wallet that lets you pay from your app wallet to your bank account. |

| The transaction maximum limit is ₹ 2,00,000. | The transaction limit is up to ₹ 200. |

| UPI requires a UPI PIN for the transaction. | UPI Lite does not need a UPI PIN to carry out transactions. |

| It relies on UPI infrastructure for the transaction. | It does not depend on UPI infrastructure for the transaction. |

| 200+ banks support UPI. | UPI Lite is accessible to only nine banks in India. |

| Multiple apps support UPI. | Only Paytm and BHIM app supports UPI Lite right now. |

| Instant payment, but sometimes it takes time to get credited. | In UPI Lite, payment is instantaneous and failproof. |

Also read: How To Link Credit Card With UPI?

Supporting Banks

UPI supports 200+ banks, but UPI Lite is accessible to only nine banks in India. This list can expand in the future; however, right now, it is made up of only nine banks.

- HDFC Bank

- Union Bank Of India

- Canara Bank

- Kotak Mahindra

- Indian Bank

- Utkarsh Small Finance

- Central Bank Of India

- Punjab National Bank

- State Bank Of India

Also read: Make Google Pay, PhonePe, PayTm UPI Payments Without Internet: Step-By-Step Guide

Steps to Enable and Use UPI Lite in Paytm

Follow the steps below to activate and use UPI Lite in Paytm.

- If you haven’t installed Paytm yet, first install the app.

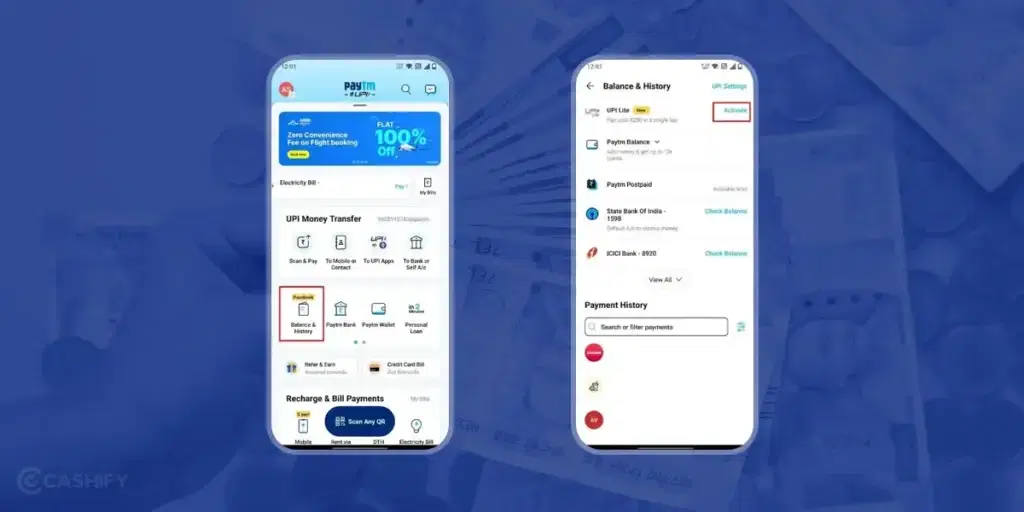

- Now, launch the app and click on “Balance and History.” Here, you will see the UPI Lite option. After that, click on “Activate.”

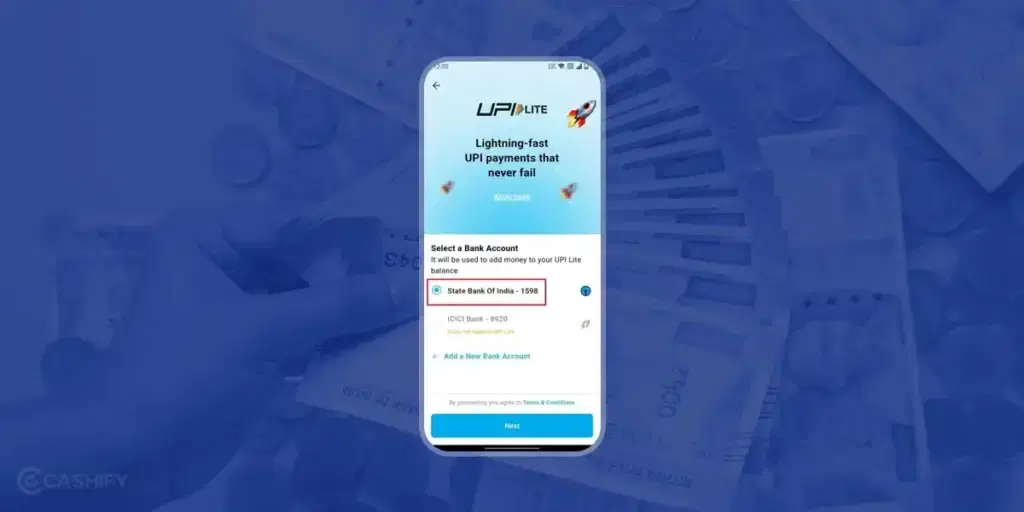

- You need to add a bank that UPI Lite supports. After that, click on Next.

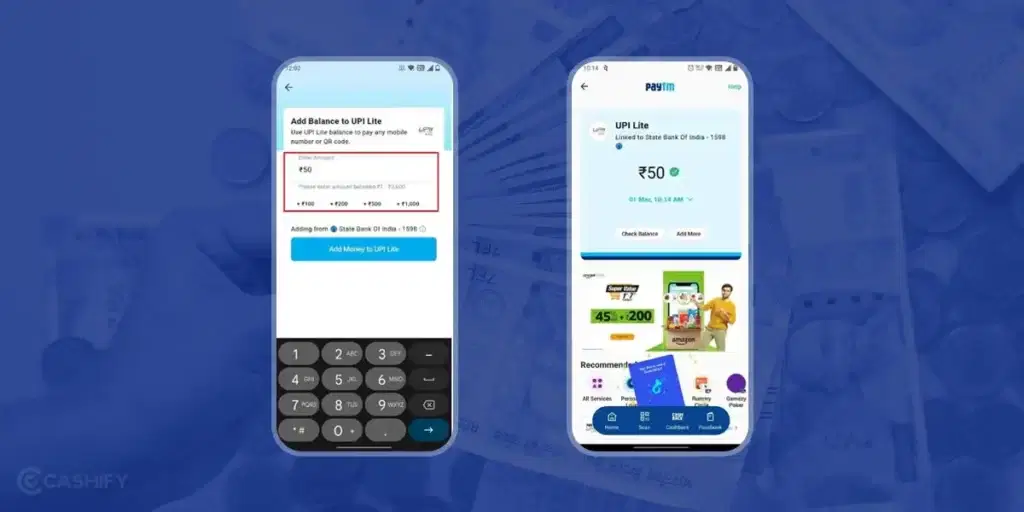

- Enter the amount that you want to transfer. Remember, here, you must enter the amount up to ₹200. Now, click on the option –“ Add Money to UPI Lite.” Enter your UPI PIN, and it’s done.

- In the next step, you can scan the QR code and pay up to ₹200 through the UPI Lite wallet. You will not require a UPI PIN for it.

Also read: UPI 123Pay: How To Make UPI Payment Via A Feature Phone?

Steps to Enable and Use UPI Lite on the BHIM App

Here are a few steps that you need to follow to enable and use UPI Lite on the BHIM app.

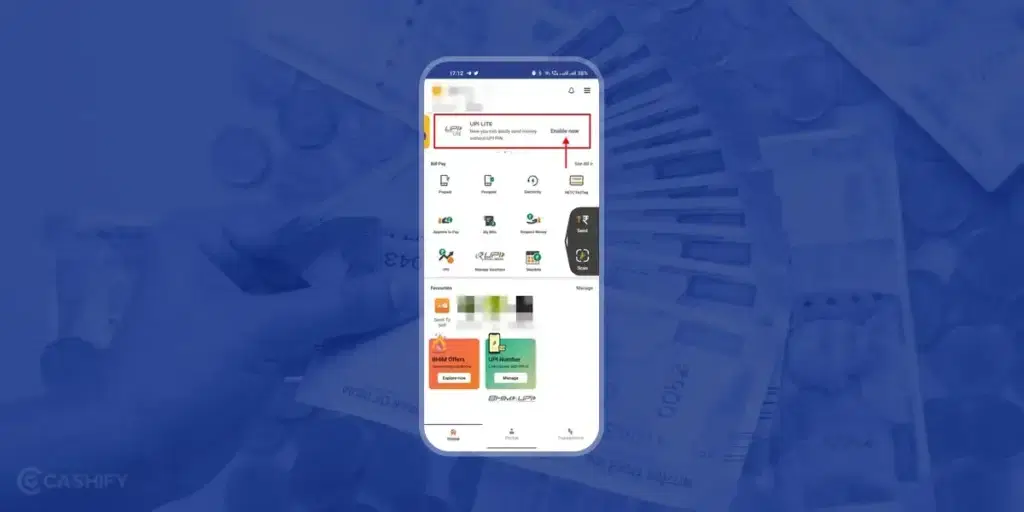

- Launch the BHIM app. Now, scroll through the UPI Lite feature and tap Enable Now.

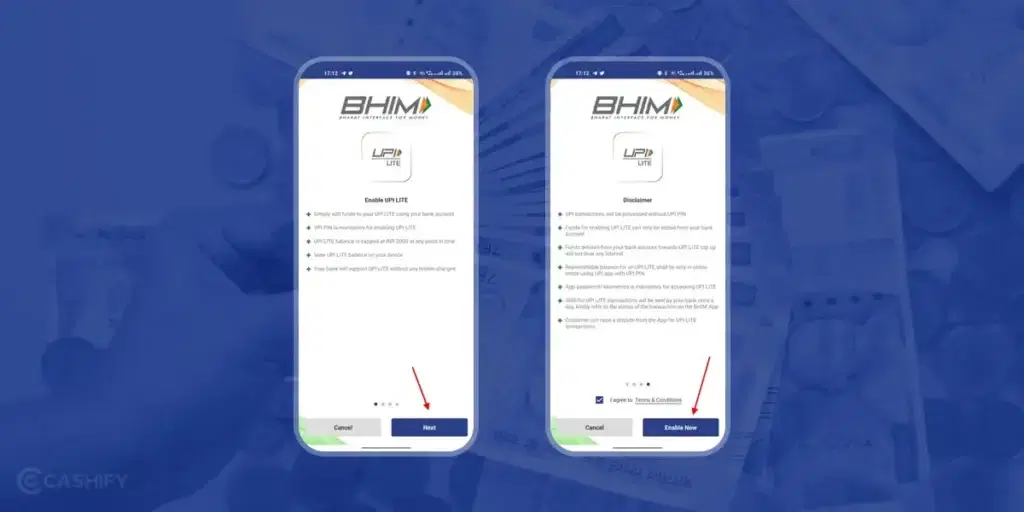

- You will see the information regarding the feature. After reading it, click on Next and check the checkbox stating terms and conditions. After that, Enable Now at the bottom.

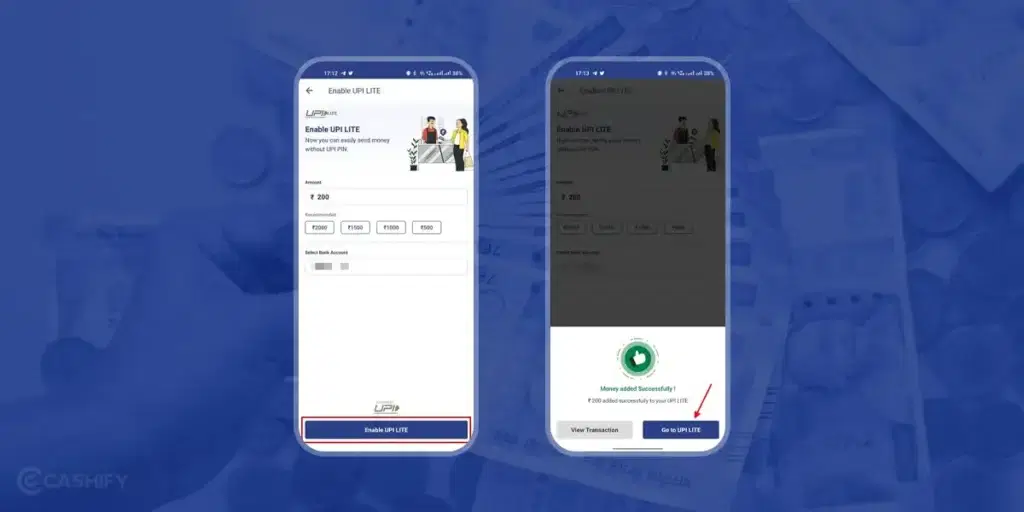

- Now, load the money into the BHIM wallet. Remember, you can add money from only supported banks. Therefore, enter the amount, choose the bank account, and click on the option – “Enable UPI Lite.” Enter the UPI PIN.

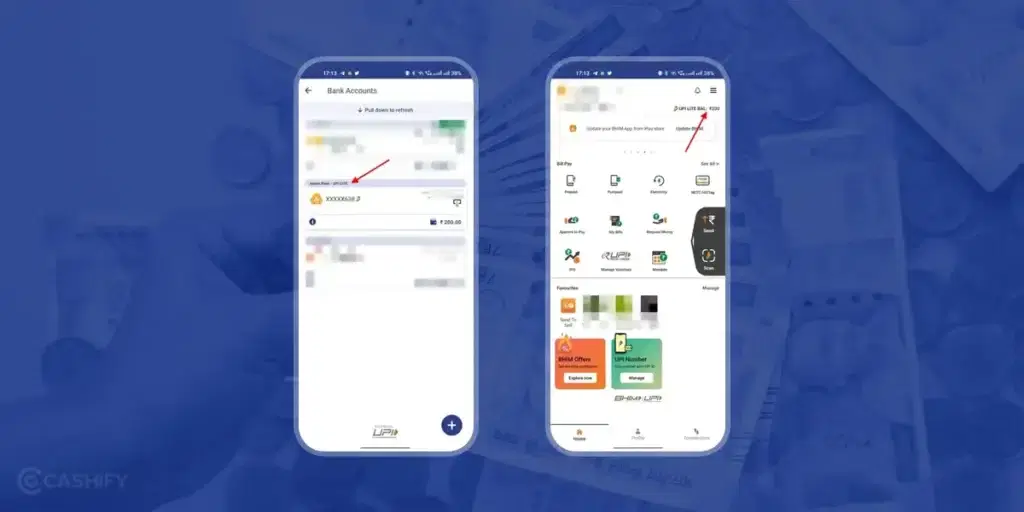

- Now, go to the Bank Account section. Here, you will be able to see your UPI Lite wallet information. You will be able to see your UPI Lite balance, as shown in the screenshot.

Also read: How To Change UPI Pin On PhonePe?

Advantages of UPI Lite

Let’s check out how beneficial UPI Lite is.

- UPI Lite is user-friendly and lightweight. So, entry-level smartphone users can also use it without any hesitation. Its simple design and minimalistic interface offer a user-friendly experience for people new to digital payment.

- It enforces top-notch security measures like two-factor authentication, OTP authentication and biometric verification. It makes sure that the transaction remains safe and sound.

- It offers transaction versatility. You can pay your bills, do merchant transactions, and do peer-to-peer transfers. And the best thing here is that you do not need to enter the UPI PIN.

- Right now, offline support is not available, but it is expected that it will be available soon. Therefore, users can make payments with low or no internet connectivity.

FAQs

Is UPI Lite Free?

Yes, it is completely free, like normal UPI and supported by all major banks.

Are UPI Lite Charges For Transactions?

No. There are no transaction charges in UPI Lite.

Can I Withdraw Money From UPI Lite?

Yes, you can withdraw money from it at any time, and that is also without any charges.

Who Invented UPI Lite?

NPIC – The National Payment Corporation Of India invented UPI Lite, which RBI supported.

Also read: How to Use Mi Pay for UPI Payments in India

To Sum Up

In summary, UPI Lite is making small transactions more straightforward and efficient. It is designed for daily small payments, such as buying snacks or paying for a cup of tea. With it, you can send money securely, quickly, and hassle-free.

For that, you don’t even need a strong internet connection. So, what are you waiting for? Download UPI Lite today, pay through it, and make your daily transactions smoother.

Also read: Explained: Why Apple Pay Is Not Available In India?

Did you know that refurbished mobile phones cost at least 10% less than new phones on Cashify? You also get other discounts, No-cost EMI and more, making it the most affordable way to buy a premium phone. So, what are you waiting for? Buy refurbished mobile phones at your nearest cashify store and avail exclusive offers.