In India, millions of promising youngsters with the world at their feet aim to make the world a better place, through means of gaining education. In most cases, students have a lot of costs that they need to cover. When they are short on cash, this might be an exceptionally steep hill to climb. In addition to the ever-increasing cost of higher education, students must also budget for housing, meals, transportation, and other necessities, as well as buy course materials like textbooks and computers.

The cumulative cost of living may be too expensive to manage, even with financial assistance from parents. An education loan is another alternative for students who do not qualify for financial aid via their school. Students may pay off their debt with these loans over longer periods of time with more adjustable interest rates and longer moratoria.

This facilitates the loan repayment process for the students when they graduate and get employment. These days, students in India may apply for a loan with ease thanks to the rise of instant lending apps for students.

If you are a student in India, you may want to check out these best loan apps for students. These apps make it easier for students to get instant loan and repay the loan once their education is complete and they have a job. These apps require minimum documentation and cut the need to go to bank branches.

5 Best Loan App For Students

Here are some of the best loan apps for students in India:

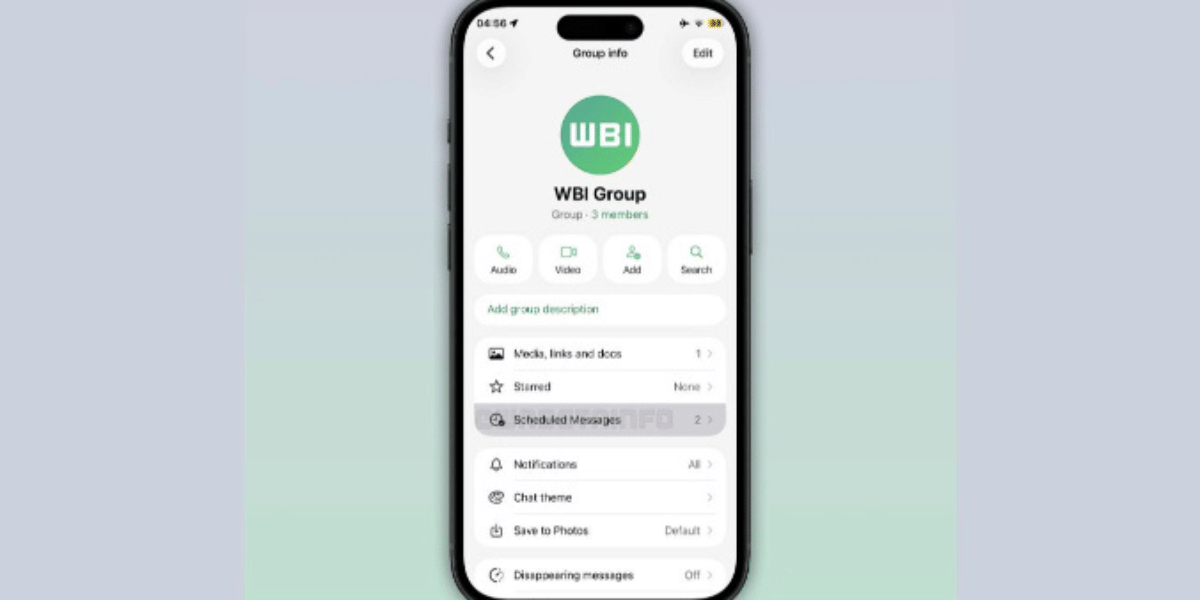

1. mPokket

mPokket is one of the most popular instant student loan apps in India. Interested students can seek amounts as low as ₹500 to ₹20,000. A legitimate college ID and proof of address are needed to apply for a loan with mPokket. Young professionals require a payment receipt, a bank statement, and ID Proof and residency document.

Download mPokket from Here

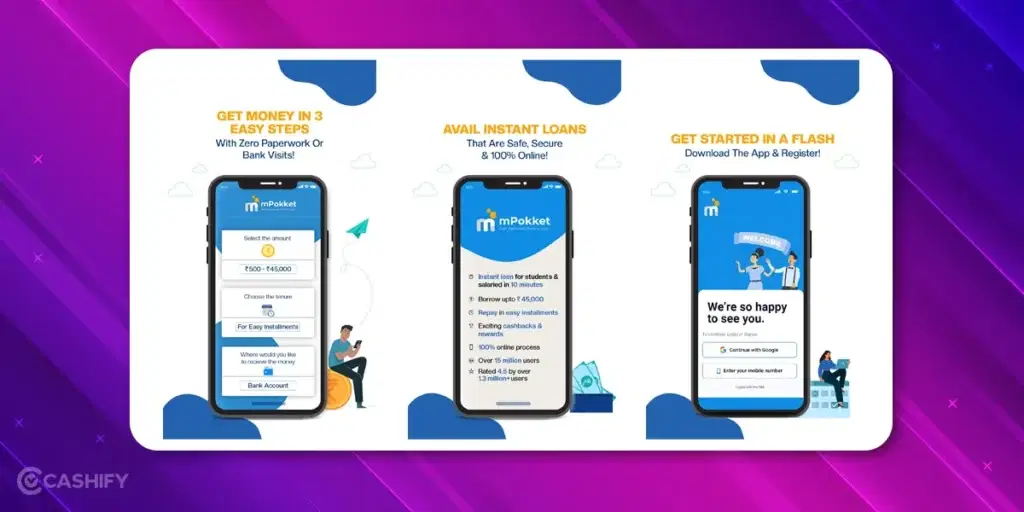

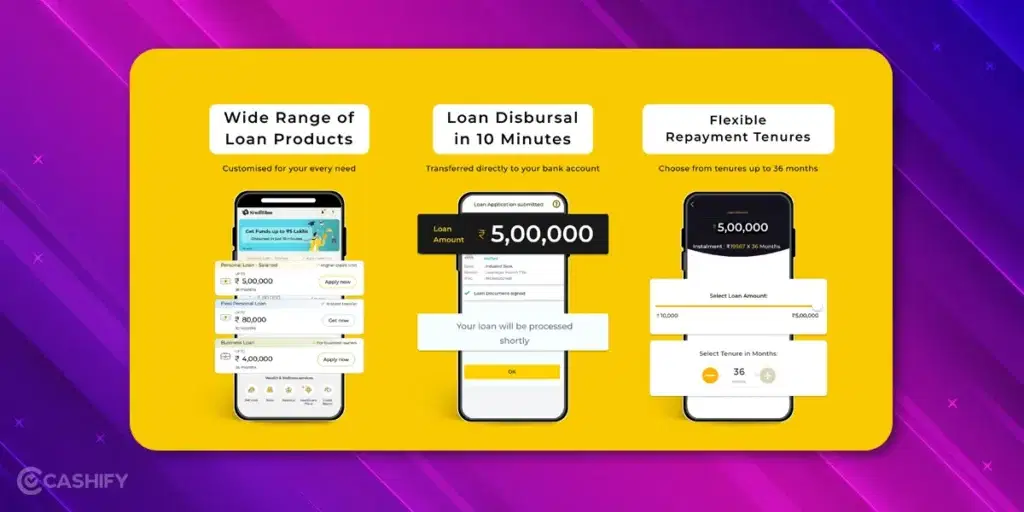

2. KreditBee

KreditBee does things a bit differently. An individual’s creditworthiness and the size of their loan determine the interest rate that KreditBee will provide them, which may range from 16% to 29.95% p.a.

CreditBee offers loans between ₹3,000 and ₹5 Lakhs, meeting a wide variety of student requirements. Whether it’s for unforeseen expenses, house rent, college fees, or textbooks, you may borrow an amount that fits your financial needs.

With KreditBee’s 10-minute loan disbursal procedure, you may get the money you need quickly, even in an emergency. Students dealing with urgent financial problems may find this function very attractive. Because of the unpredictability of student life, KreditBee offers flexible repayment options. They also provide adaptable repayment plans so you may make payments that work with your income and expenses.

Download KreditBee from HERE

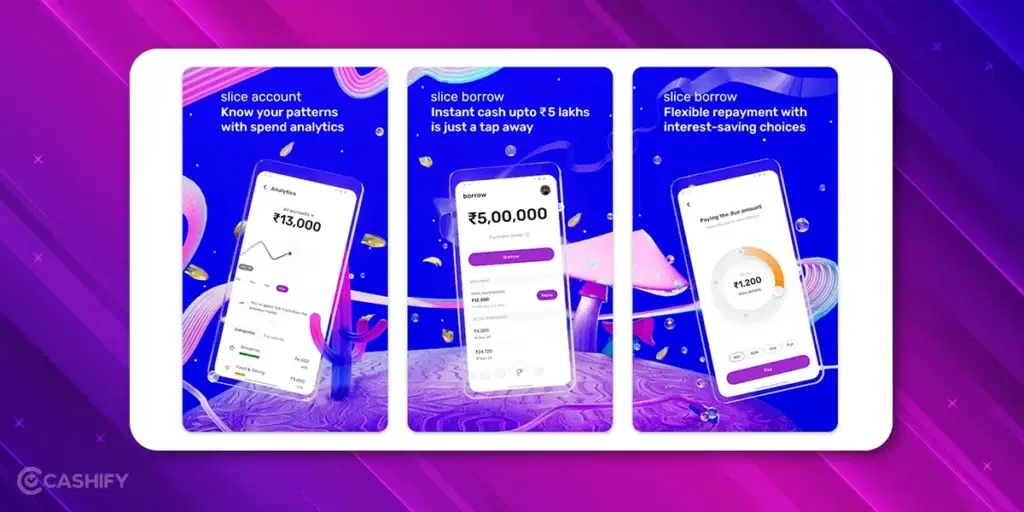

3. SlicePay

SlicePay is another popular app to get instant loans for students. To signup for the app, you’ll need to submit your name, college details, your ID, and information about your Aadhar and PAN.

Undergraduate and graduate students may apply for loans from SlicePay upto ₹10,000. The duration of their loans ranges from thirty to ninety days. Also, there’s a 3% monthly interest charge with SlicePay. Once the loan application is approved, the money will be sent directly to your bank account.

Download SlicePay from HERE

4. Stucred

An Indian fintech firm, StuCred, established in 2018 works with the primary goal of offering quick, short-term loans to students enrolled in college. In order to help students manage their costs, the website provides simple and fast access to credit, so they don’t have to depend on conventional banking systems or family for assistance. With StuCred’s mobile app, students may apply for loans, get approval, and get the money quickly. The services are designed to be user-friendly.

To guarantee ethical financing, the app makes use of data analytics and technology to determine a student’s creditworthiness. A student may apply in a jiffy by registering on the app, filling out some basic academic and personal information, and attaching any required papers. Once they’ve been verified, students may apply for micro loans that will cover things like books, supplies, and social activities.

Students can apply for personal loans using this app and get up to ₹15,000 instantly. Students can borrow money from the app without paying interest for a fixed duration of loans. For this, the service seeks to charge you 6% interest on the borrowed amount every 30 days, plus late penalties if you don’t return on time.

Download Stucred from HERE

5. Pocketly

Pocketly helps students become financially independent by giving them easy access to modest loans using a smartphone app. Students may use this service to handle their spending on things like books, supplies, and unforeseen fees without having to depend on conventional banking systems or relatives for help.

Pocketly has an easy and quick application procedure. Students must sign up for the app, fill out mandatory fields on their academic and personal information, and attach necessary papers to verify their identity. After getting the green light, students may apply for loans, usually for modest sums that are enough for regular bills.

With a payback term ranging from 61 to 120 days, it provides loans ranging from ₹500 to ₹50,000. Pocketly offers 0% APR for the first month and starts at 24% interest with no collateral or co-signer required as an essential.

Download Pocketly from HERE

It’s time to upgrade to a better phone. Sell old mobile phone and buy refurbished mobile phone from top brands like Apple, OnePlus, Samsung, Xiaomi and more at almost half price. Buy smart, buy refurbished.