India is leading the world in FinTech. The UPI (Unified Payments Interface) has changed many things. We lead the world in digital payments. UPI is a fast, secure, and instant way to transfer money using mobile phones. Now we can see a new feature called UPI Circle, introduced by NPCI. It can allow multiple users to share a single UPI ID.

This feature allows the primary account holder to give payment authority to trusted people. Now you can use UPI without needing a bank account. In this guide, we’ll cover everything about UPI Circles in detail. You will also see how you can set it up in Google Pay, PhonePe, and Paytm. So, let’s get started:

Also Read: Top Phones with Stock Android: Clean, Fast & Bloat-Free

What is UPI Circle?

UPI Circle is a payment feature. One primary user can share their UPI ID with trusted people. The primary user can share the UPI ID with up to five people. These people can make payments using the primary user’s account. The main user can set limits and rules for the UPI Circle.

It’s useful for those without bank accounts or who are not familiar with digital payments. This includes children, elderly family members, or workers.

Key Features Of UPI Circle

- With UPI Circle, multiple users can access a single UPI ID that is linked to a primary account.

- Secondary users can make transactions within a monthly limit of Rs. 15,000. The per-transaction limit is Rs. 5,000, without requiring approval from the primary user.

- The secondary user can initiate a payment request, which the primary user must approve by entering their UPI PIN.

- The primary user can monitor transactions and even remove access at any time.

- A 24-hour cool-off period limits secondary users to Rs. 5,000 in transactions after being added.

- The user can only add up to five members.

- There are no charges required, and it is free for both primary and secondary users.

Also Read: Best AI Smartphone? iPhone 16 Vs Galaxy S25 Vs Pixel 9

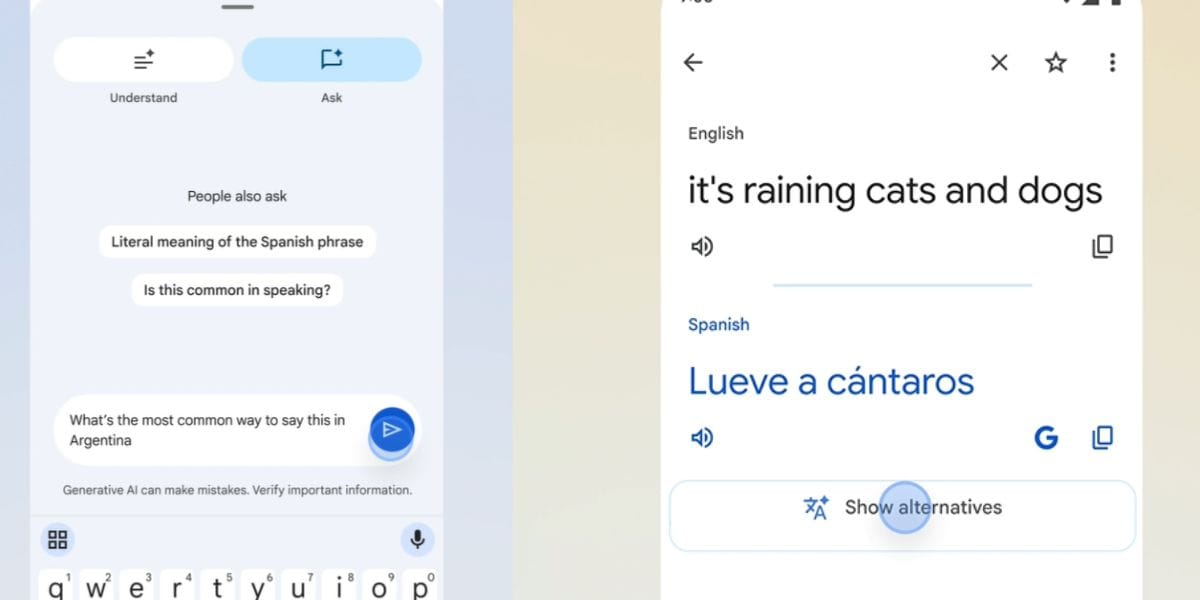

How to Set Up UPI Circle on Google Pay, PhonePe, and Paytm?

In India, many apps let you use UPI. It includes Google Pay, PhonePe, Paytm, and many others. Let’s check out how to set up UPI Circle on various platforms:

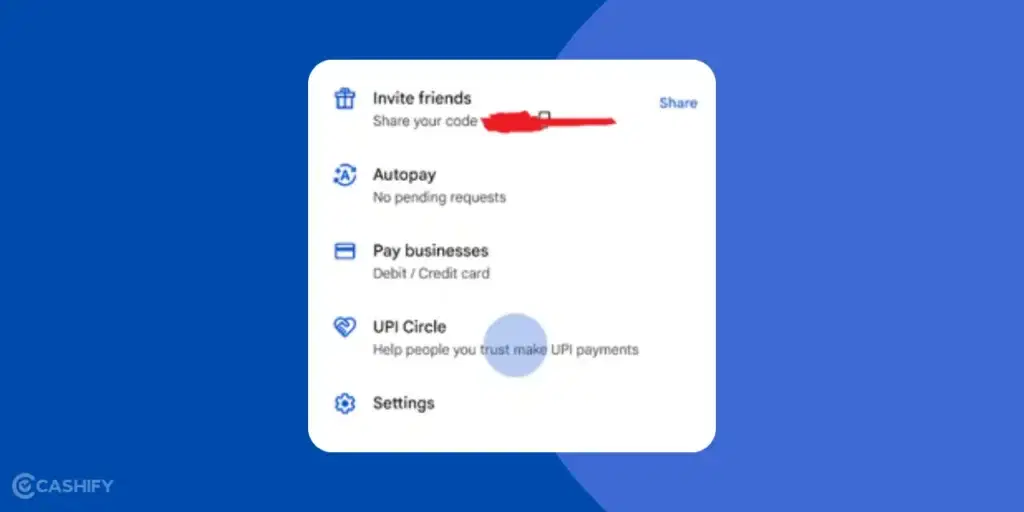

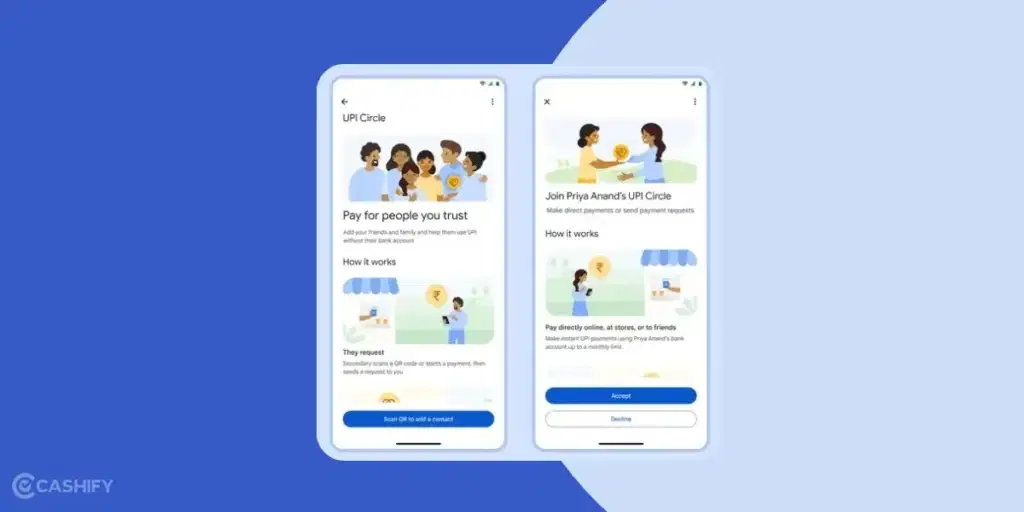

How To Set Up UPI Circle on Google Pay?

The UPI Circle on Google Pay feature is available on both Android and iOS. Let’s check out how to set it up:

- Open Google Pay.

- Tap your Profile Picture at the top right.

- Select UPI Circle and tap on ‘Add People to your UPI Circle’.

- Scan the Secondary User’s QR Code or enter their UPI ID. Make sure to verify the phone number from your contact list.

- You can choose Full delegation (Monthly Limit Rs. 15,000). There is Partial Delegation, where you have to approve each transaction.

- Confirm the bank account.

- Tap proceed and enter your UPI PIN. The other user will receive a notification to accept the invite.

Also Read: Snapdragon Processors List: Specs, Benchmarks, Best Picks!

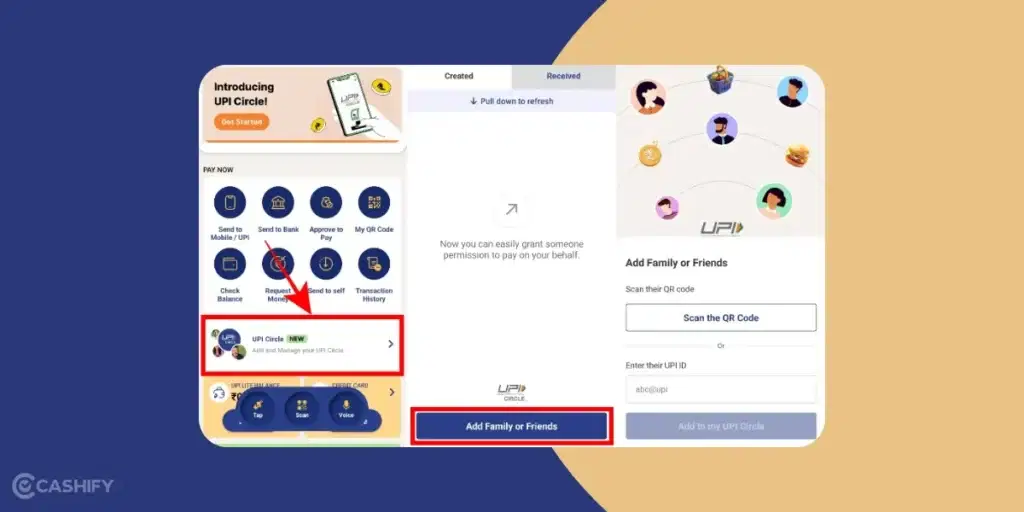

How To Set Up UPI Circle on PhonePe?

PhonePe has also rolled out UPI Circle with Partial Delegation support. Full Delegation can also be there in the upcoming updates. The setup is similar to Google Pay but with a few variations. Let’s check out:

- Open the PhonePe app and tap on your Profile Picture in the left corner.

- Go to UPI & Payment Settings > UPI Circle > Add Family or friends.

- Enter the secondary’s UPI ID or Scan the QR Code. Verify the mobile number.

- Choose ‘Approve Every Payment’ Partial Delegation.

- Confirm the details after setting the bank account. Send the activation after entering UPI PIN.

Also Read: Wireless Charging Explained: How Does It Work On Mobile Phones?

How To Set Up UPI Circle on Paytm?

Paytm supports UPI Circle. The setup process is simple, with options for both Full and Partial Delegation.

- Open Paytm and Tap your Profile Picture.

- Go to UPI & Payment Settings > UPI Circle > Add Family or Friends.

- Enter their UPI ID or scan the QR code, then verify their mobile number.

- Choose ‘Spend with limits’ under Full delegation. Choose ‘Approve Every Payment’ under Partial Delegation.

- Set up bank account > Confirm > Enter UPI PIN to activate.

Note: Paytm is still rolling out this feature. So, there is a chance that it will take time for you to get this feature.

Also Read: 5 Phones You Can Buy Instead Of iPhone 16 Pro!

Quick UPI Circle Guide For Secondary User

- Open Google Pay/ Paytm / PhonePe.

- Go to Profile Picture > UPI Circle > Join UPI Circle.

- Share the QR Code with the Primary User.

- Once you receive the invitation from the Primary User, tap ‘Join UPI Circle’ from the notification.

- Confirm all the details. Scan a QR Code to pay or enter your UPI ID/ Phone Number.

- For Full Delegation, transactions within limits complete automatically. For Partial Delegation, send a payment request to the primary user. They must approve it within 10 minutes.

Also Read: Reasons You Should Choose Android Over iOS.

Things To Note

There are a few things to keep in mind.

- A 30-minute cool-off period is there when you link a member. During this, no transactions are allowed.

- The secondary user’s first 24 hours are limited to Rs. 5,000.

- To remove a secondary user, go to UPI Circle > You pay for > select the user > Remove.

- Both users can view transaction history in the UPI Circle section for transparency.

- On Paytm, the secondary users can pay for recharges, bills, and more.

- Paytm supports RuPay Credit Card payments via UPI.

Tips For Avoiding Any Scam While Using UPI Circle

- Add only trusted individuals to your UPI Circle to prevent fraud.

- Use the Full Delegation option for Children. For employees, househelp, and more, you can use Partial Delegation.

- Regularly check the transaction history to detect any unusual activity.

- Never share your UPI PIN with secondary users, as it’s required only for primary user approvals.

You might like these too:

In A Nutshell

UPI Circle is a good and helpful feature. It helps more people use UPI easily. The primary user can share their UPI ID with trusted people. These people can make payments from the primary user’s account. It is helpful for families, workers, or small businesses. It helps reduce cash use and supports digital payments.

If you’ve just bought a new phone and don’t know what to do with your old phone, then here’s your answer. Sell old mobile to Cashify and get the best price for it. If you are planning to buy a new phone, check out Cashify’s refurbished mobile phones. You can get your favourite phone at almost half price with six-month warranty, 15 days refund and free delivery.