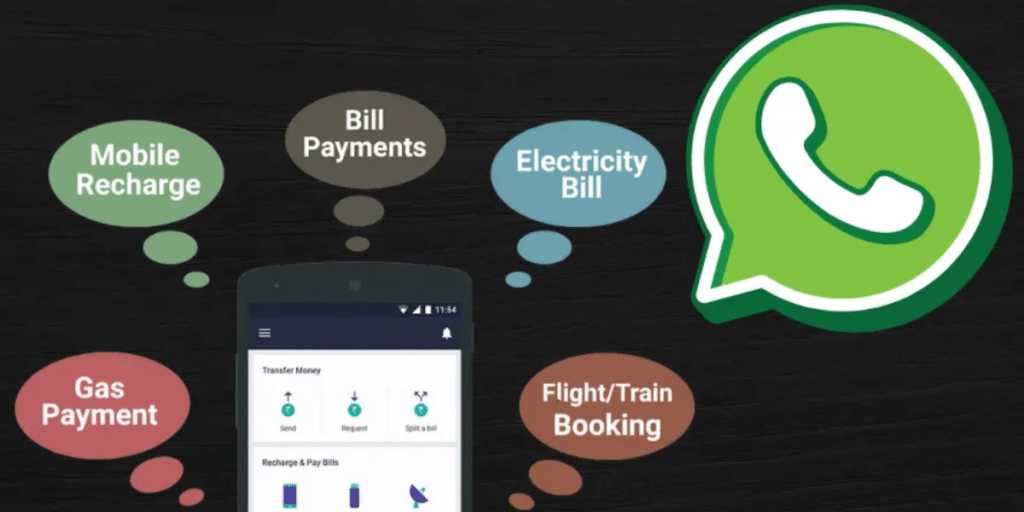

WhatsApp is updating its app to let users in India pay for utilities like electricity and water directly through the app. This feature is currently being tested in the Android Beta version 2.25.3.15, aims to transform WhatsApp into a more versatile platform. Soon, users will be able to handle various payments such as electricity, water, mobile recharges, and rent all in one place. This new feature will eliminate the need to switch between different apps for payment tasks, making WhatsApp a convenient one-stop solution for managing payments.

CshComponent type=”adSlotSquareComponent” slotId=’5991860688′]

Know What All You Can Pay With WhatsApp Bill Payment

WhatsApp has been adding new features recently, such as online payments, UPI transactions, and tools for businesses. Now, the company plans to offer even more by allowing users to pay bills and recharge mobile phones directly through the app.

Also Read: 50+ Best WhatsApp About Quotes To Suit All Mood

Reports indicate that WhatsApp is testing a bill payment feature. When launched, users will be able to:

- Pay electricity and water bills

- Recharge mobile phones

- Pay rent for houses or flats

This feature will make it easier for users who often handle these payments through various platforms. By using WhatsApp for these transactions, users can enjoy a smoother and more secure way to pay their bills all in one place.

Also Read: How To See Deleted Messages On WhatsApp- Tricks You Need To Know

WhatsApp Challenges Major Payment Apps

With this new bill payment feature, WhatsApp is positioning itself to compete with major payment platforms. To name a few, Google Pay, PhonePe, and Paytm. By integrating easy payment options within its app, WhatsApp is challenging these established services. It is trying to grab a piece of the digital payments market. Currently, PhonePe leads with a 47.8% market share, with Google Pay following at 37%.

Also Read: Apple iPhone 16 Battery Life: Is It Better Than The iPhone 15?

Integration With WhatsApp Pay

The new bill payment feature will be part of WhatsApp’s existing UPI-based payment system, WhatsApp Pay, which launched in 2020. Initially, WhatsApp Pay was available to a limited number of users due to regulatory approvals. But, now it has now received approval from the National Payments Corporation of India (NPCI) to be available to all users in India. This approval allows WhatsApp to use its huge global user base of 3.5 billion people. They will be used for seamless payment transactions, simplifying the management of daily financial tasks through one app.

CshComponent type=”adSlotSquareComponent” slotId=’5991860688′]

WhatsApp’s move to add bill payment capabilities not only makes payment processes easier for everyday expenses. It also positions the app as a strong contender in the digital payments industry. As WhatsApp continues to improve and test this feature, users can expect a more streamlined way to manage their payments in the near future.

Read More : [Report] WhatsApp Mods- Stay Away From GB WhatsApp, FM WhatsApp

Turn your dream of buying an iPhone into a reality. Buy Refurbished Apple iPhone from Cashify at almost half price. It is like-new, available for purchase on no-cost EMI, and includes a 6-month warranty, which you can claim at any of Cashify’s 200+ stores.