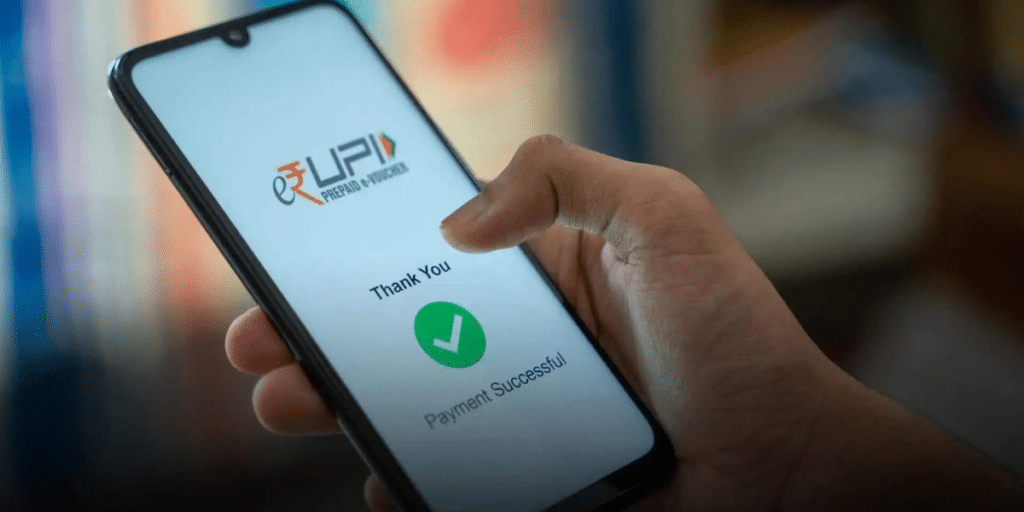

Beginning October 1, 2025, the way Indians use the Unified Payments Interface (UPI) will undergo a change. The National Payments Corporation of India (NPCI) has revealed that it will be discontinuing the money request feature for person-to-person (P2P) transfers. This change aims to curb the rise of scams that have been increasingly affecting unaware users. So, read ahead to know everything about the UPI money request feature.

About The UPI Money Request Feature

The UPI money request feature was, in theory, a convenient tool. Instead of directly asking someone to send money, you could easily send a request—whether it was for splitting the bill after dinner or reminding a friend about that Rs 500 they still owed. The recipient could then choose to approve or decline.

Also Read: Best UPI App For Cashback August 2025: Top Options To Save Money!

NPCI’s new directive of removing money request feature is clear-cut. Starting October 2, “no P2P collect transaction should be initiated, routed, or processed,” according to a notice sent to banks, payment providers, and UPI apps. This means systems must be updated to completely block these requests.

How Will It Be Safe For Users?

By eliminating P2P collection, NPCI is addressing what it views as one of UPI’s most vulnerable security points. Approving a fraudulent request was as simple as a careless tap, making it a popular tactic in online scams. Removing the money request feature of UPI move aims to protect users, it also means that genuine users will lose a convenient shortcut. Instead of sending a request, you’ll now need to directly ask for your share—whether by sharing your UPI ID, generating a QR code, or simply sending a payment reminder via WhatsApp.

Fraudsters have used various tactics, from phishing texts and fake OTP requests to impersonating bank officials. The collect request feature was simply another tool in their arsenal. NPCI argues that removing it is a proactive step to strengthen security before the issue escalates further.

For most people, though, not much will change. Sending money will still be fast, free, and widely accepted.

Are you still browsing through your broken screen? Don’t worry! Book at-home mobile phone screen repair with Cashify—an affordable and one-stop destination for all your mobile phone needs. In case you break your screen within 1 month of repair, we will replace your screen again—for FREE.