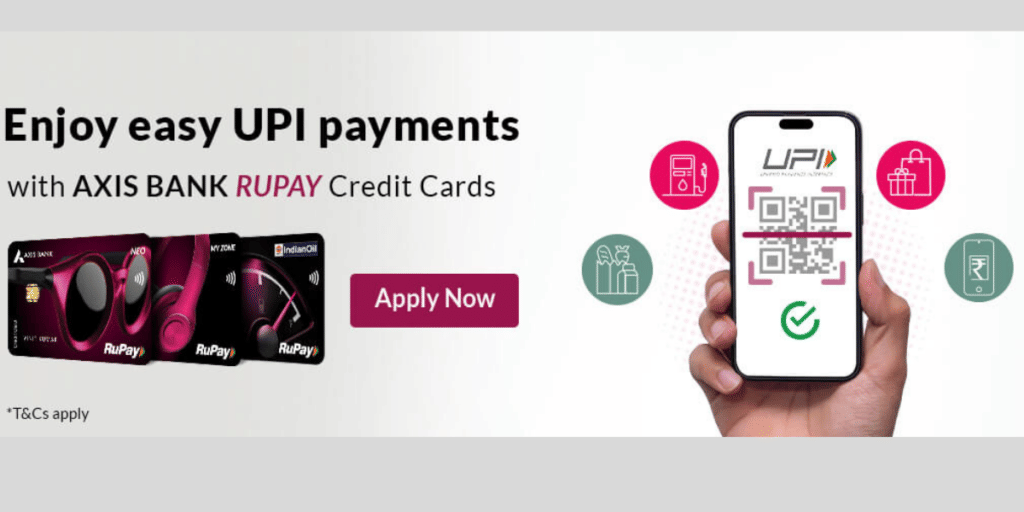

In a groundbreaking move, Axis Bank and Google Pay have launched the Axis Bank’s UPI credit card, known as the Google Pay Flex Axis Bank Credit Card. This innovative product marks India’s first fully digital, UPI-powered co-branded credit card, built on the RuPay network. It seamlessly blends the ease of UPI transactions with the flexibility of credit, allowing users to pay like they do with UPI while enjoying credit benefits. The launch targets digital-first consumers who prefer quick, secure, and rewarding payment options.

Announced on December 17, 2025, the Axis Bank’s credit card integrates directly into the Google Pay app. Users apply digitally at no cost, get approved in minutes, and start spending immediately without any physical card or paperwork. This card empowers millions to access credit effortlessly, bridging the gap in India’s underpenetrated transactional credit market. So, here is everything you need to know about this credit card.

Key Features Of Axis Bank’s UPI Credit Card

The Axis Bank’s UPI credit card offers a host of user-friendly features designed for modern lifestyles:

Also Read: How to Make UPI Payments Using Your Fingerprint or Face ID

- Fully digital application and instant activation through the Google Pay app.

- UPI-style payments at millions of offline merchants and online platforms via the RuPay network.

- Earn “Stars” as rewards on every transaction (1 Star = Re 1), redeemable instantly for cashback.

- Track spending, pay bills in full, or convert balances into easy EMIs directly in the app.

- In-app controls for security, including instant block/unblock and PIN reset.

What Experts Say About The Launch?

Leaders from both companies highlight the potential of the Axis Bank’s UPI credit card. Arnika Dixit, President and Head of Cards, Payments, and Wealth Management at Axis Bank, explains, “With UPI emerging as the preferred mode of payment, we saw a clear opportunity to create a tailored credit solution for digital consumers. This card combines our financial expertise with Google Pay’s technology for a secure and rewarding experience.”

Sharath Bulusu, Senior Director of Product Management at Google Pay, adds, “Digital payments are everywhere in India, but credit access lags behind. Flex reimagines the card experience for the next generation, giving users more control over daily spends.”

Sohini Rajola from NPCI praises the initiative, stating it makes everyday payments smarter and more seamless.

The rollout begins now, with full availability in coming months. Interested users can join the waitlist in the Google Pay app. This UPI credit card sets a new standard for convenient, rewarding credit in India’s booming digital economy.

Are you still browsing through your broken screen? Don’t worry! Book at-home mobile phone screen repair with Cashify—an affordable and one-stop destination for all your mobile phone needs. In case you break your screen within 1 month of repair, we will replace your screen again—for FREE.